City has a proposed balanced budget for the next fiscal year

PART 1: Thanks to Measure U, a little help from the county and some vacancies in city departments, the budget will be balanced for the first time in several years

This is Part 1 of a two-part article on the proposed budget for 2025-26.

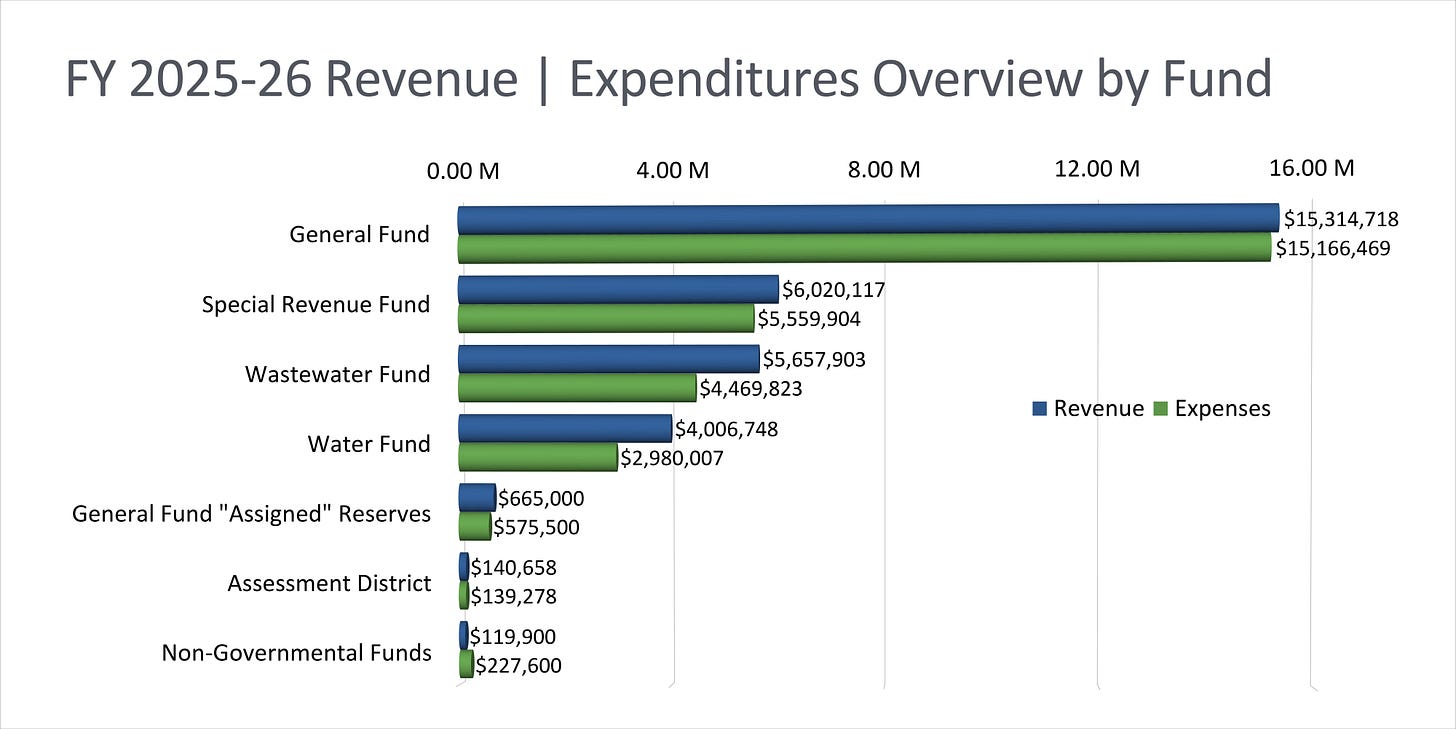

A first look at the proposed budget for 2025-26 suggests that the city may have a balanced budget this year. The 2025–26 General Fund budget projects $15.31 million in revenue and $15.17 million in expenditures, resulting in an estimated surplus of $148,249, which makes it the city’s first balanced budget since 2018.

Mayor Stephen Zollman, Vice Mayor Jill McLewis, Councilmember Phill Carter, Councilmember Neysa Hinton, and Councilmember Sandra Maurer were present for the June 17 Sebastopol City Council meeting.

Administrative Services Director Ana Kwong gave the presentation on the budget at the June 17 meeting. She started with an overview and then went department by department. This article will discuss the first part of her presentation—the overview. In part two, we’ll look at the finances for each department in the city.

After her initial presentation, Councilmembers Sandra Maurer and Phill Carter, who were on the budget committee, gave some preliminary remarks.

“I’m so grateful to be presenting to you tonight a balanced budget,” Maurer said. “In fact, it’s a little bit in positive so that feels really, really good to have that. Thanks in part to Measure U, which passed. So I want to thank the residents for that because that’s making a really big difference for the city. We also had some one-time building fees that were helping this particular year’s budget. So I’m feeling really hopeful about how much progress we’ve made.”

Carter joked that his goal this year was to “make the budget boring again.” Echoing Maurer, he thanked the staff. “It was a great process, I’m grateful, and I think that we did a good job,” he said. “This is step one of getting back to a much better place.”

A quick primer on the impact of Measure U on the 2025-26 budget

As you may recall from our last City Council Recap, Bob Leland of Baker Tilly gave a presentation on the proposed 2025-26 budget at the bitter end of the June 3 council meeting. In making this presentation, he assumed that the city would continue to receive just half of the Measure U tax and no money from the Barlow Hotel—neither development fees or TOT taxes. At the time, he noted, “Should either of those two things occur, or optimistically, both occur—that you get the extra quarter cent and the Barlow Hotel—then this situation changes markedly.”

Councilmember Hinton and Vice Mayor McLewis requested to see what his analysis would look like with the full Measure U half-cent sales tax and a new hotel thrown in—should one of these ever actually be built in our fair city.

By the June 17 meeting, the new baseline budget assumed that the city would get the full half-cent sales tax from Measure U from 7/25-12/25. After that, from 1/26 to 6/26 the city would only receive a quarter cent of the Measure U sales tax increase. This left the city with a larger budget surplus than that predicted on June 3.

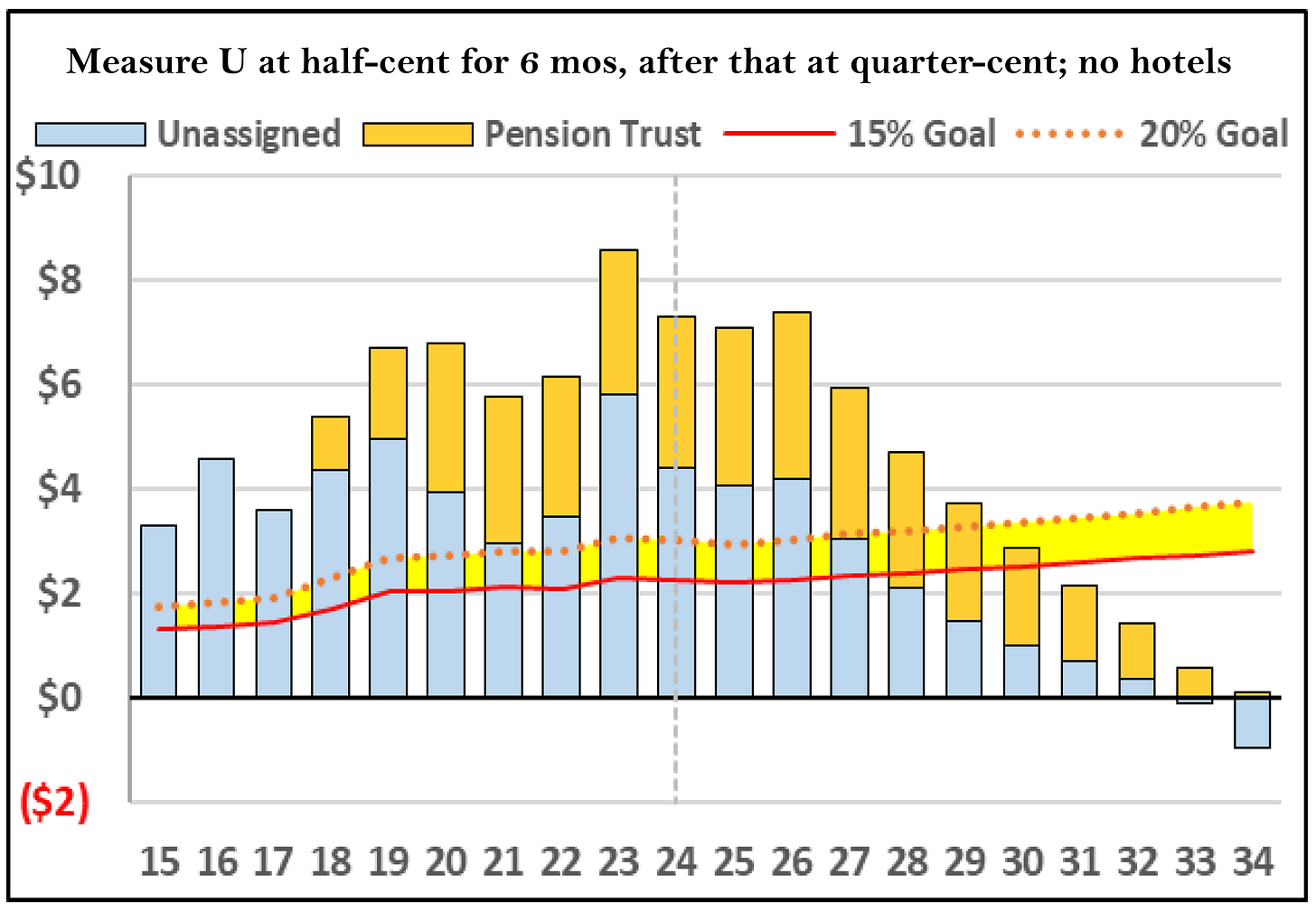

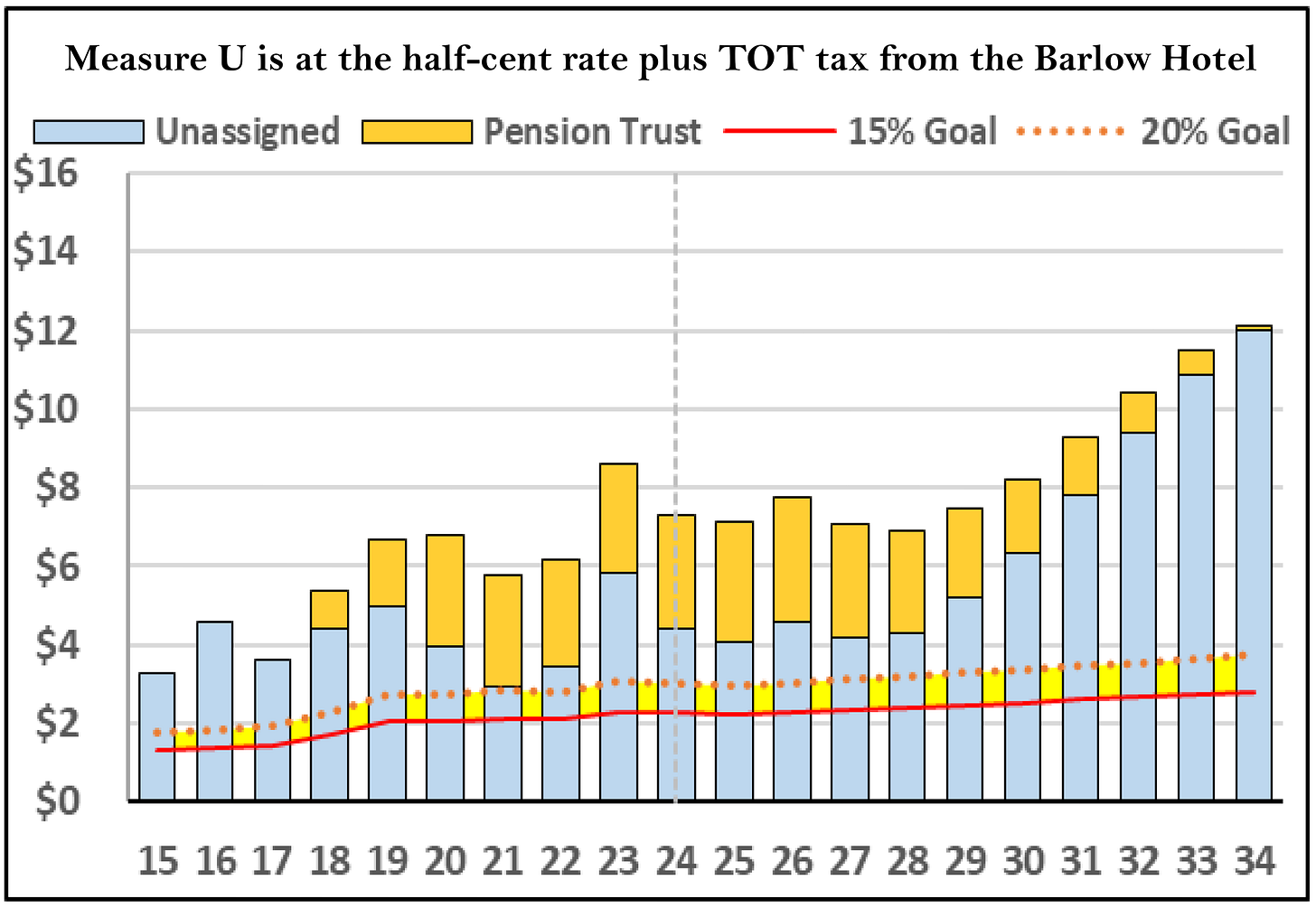

Before you get too excited, Sebastopol isn’t out of the woods yet. Under the current scenario, though this year’s budget is balanced, things begin to go south rather quickly after a few years. Here is the baseline projection on which next year’s (2025-26) budget is based:

Several future scenarios

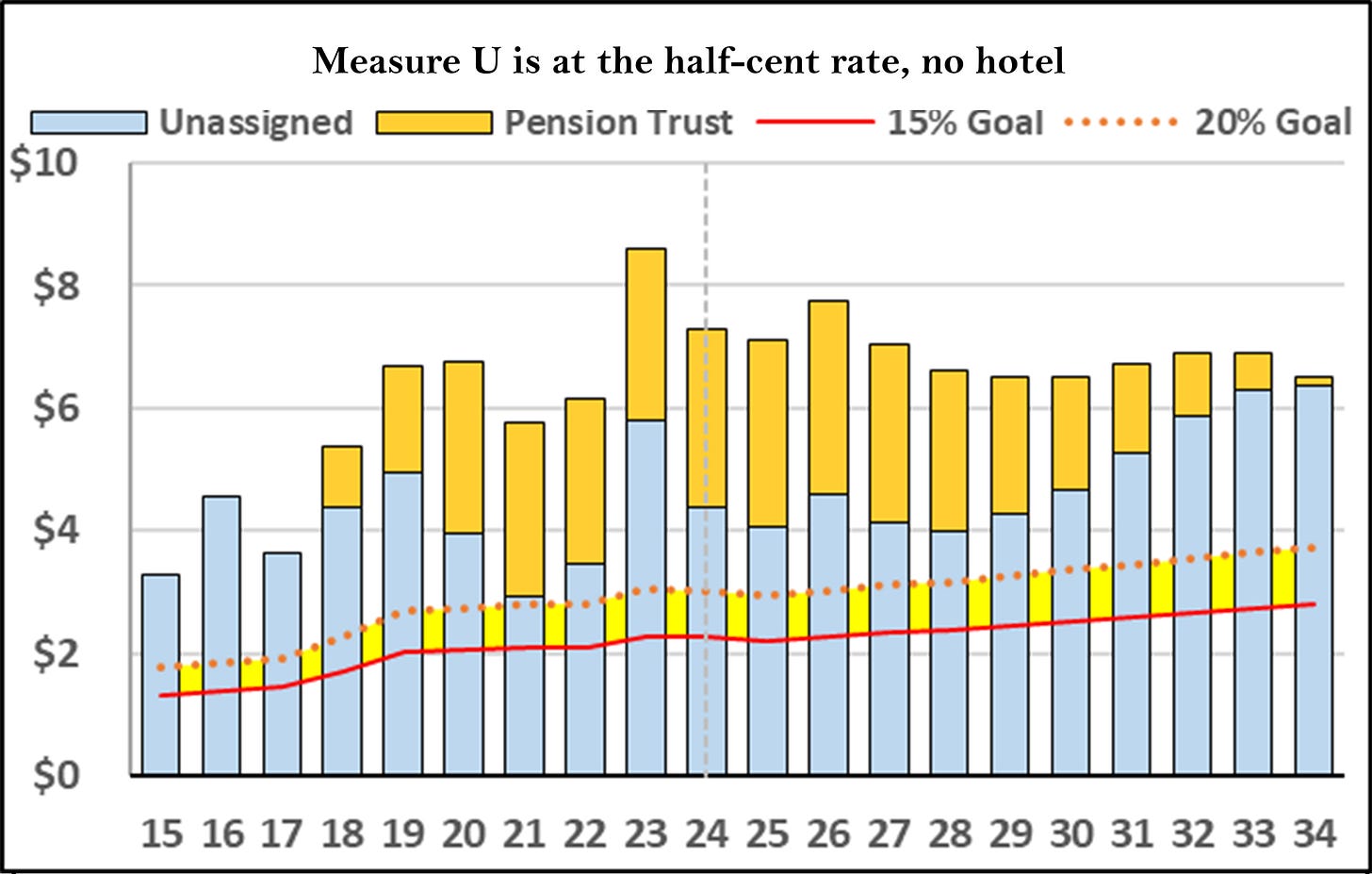

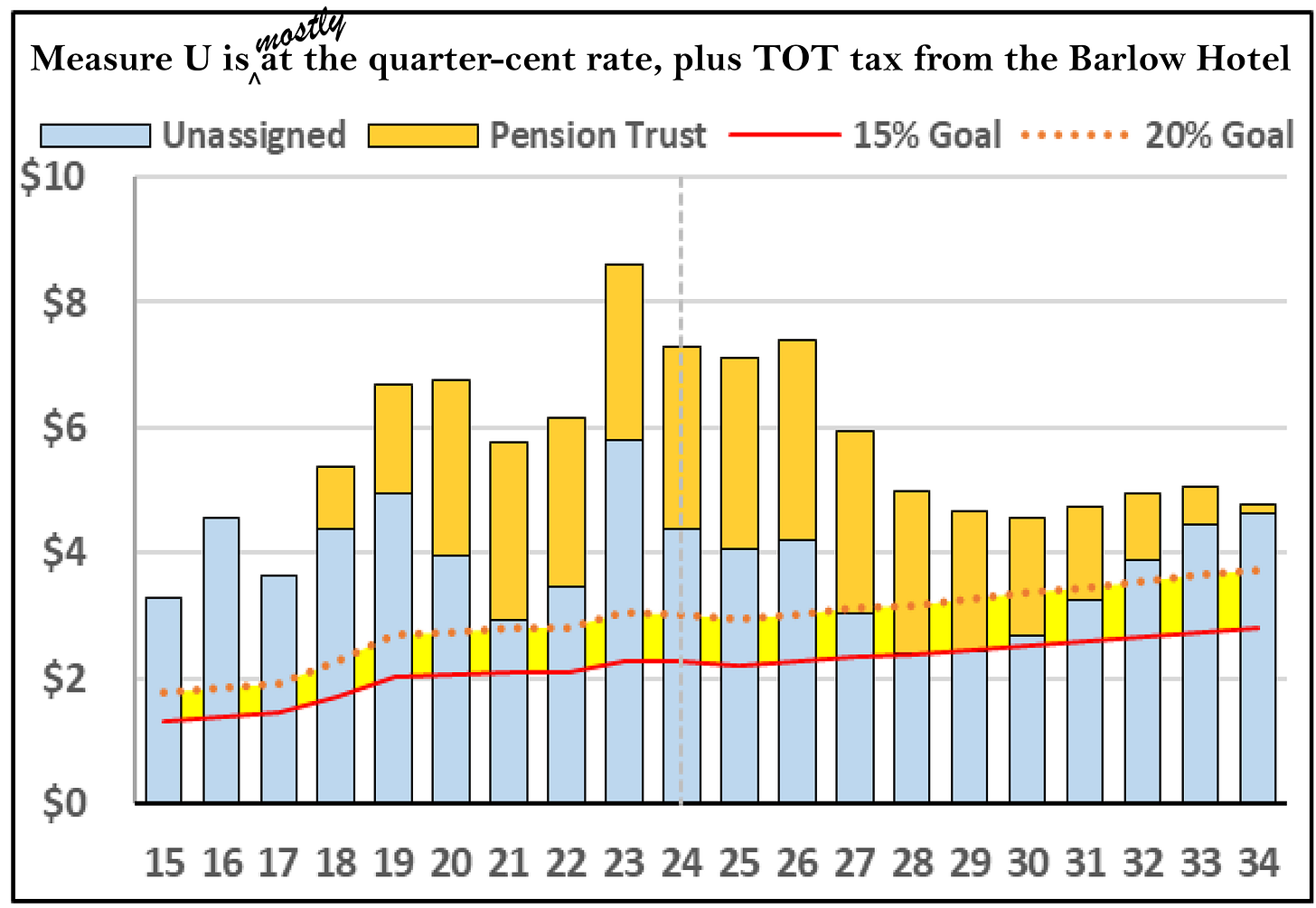

As requested by councilmembers at the previous meeting, Bob Leland, the city’s consultant from Baker Tilly, provided three alternative future scenarios, which Kwong explained during her presentation:

Note: The Sebastopol Times added titles to these charts for clarity

Alternative 1: Measure U at the full half-cent rate, with no hotel. (If this slide looks unfamiliar, that’s because it was not included in the public presentation, which accidentally used the wrong slide to represent this alternative. This is the correct slide.)

Alternative 2: Measure U is at the half cent rate for six months, then drops back to the quarter-cent rate, plus the city gets building fees and TOT tax from the Barlow Hotel.

It seemed unlikely to this reporter that Alternative 2, which included the hotel, would show lower numbers than Alternative 1, but when Kwong forwarded my concerns via email to Baker Tilly, Leland responded like so: “By FY32 the Barlow Hotel is expected to generate more annual revenue than getting the 0.25% portion of the sales tax to remain in effect. However, the hotel is assumed to phase-in to its revenue-generating capacity, and that is the difference. There is a considerable amount of uncertainty about what a high-end hotel will do in a market that has not had such a hotel to date. The Barlow developer envisions higher revenue generation, and that would be great, but it will take a couple years of experience before the realistic revenue-generating capacity of the Barlow will be known.”

Alternative 3: Measure U is at the half-cent rate, plus the city gets building fees and TOT tax from the Barlow Hotel.

The 30,000-foot view

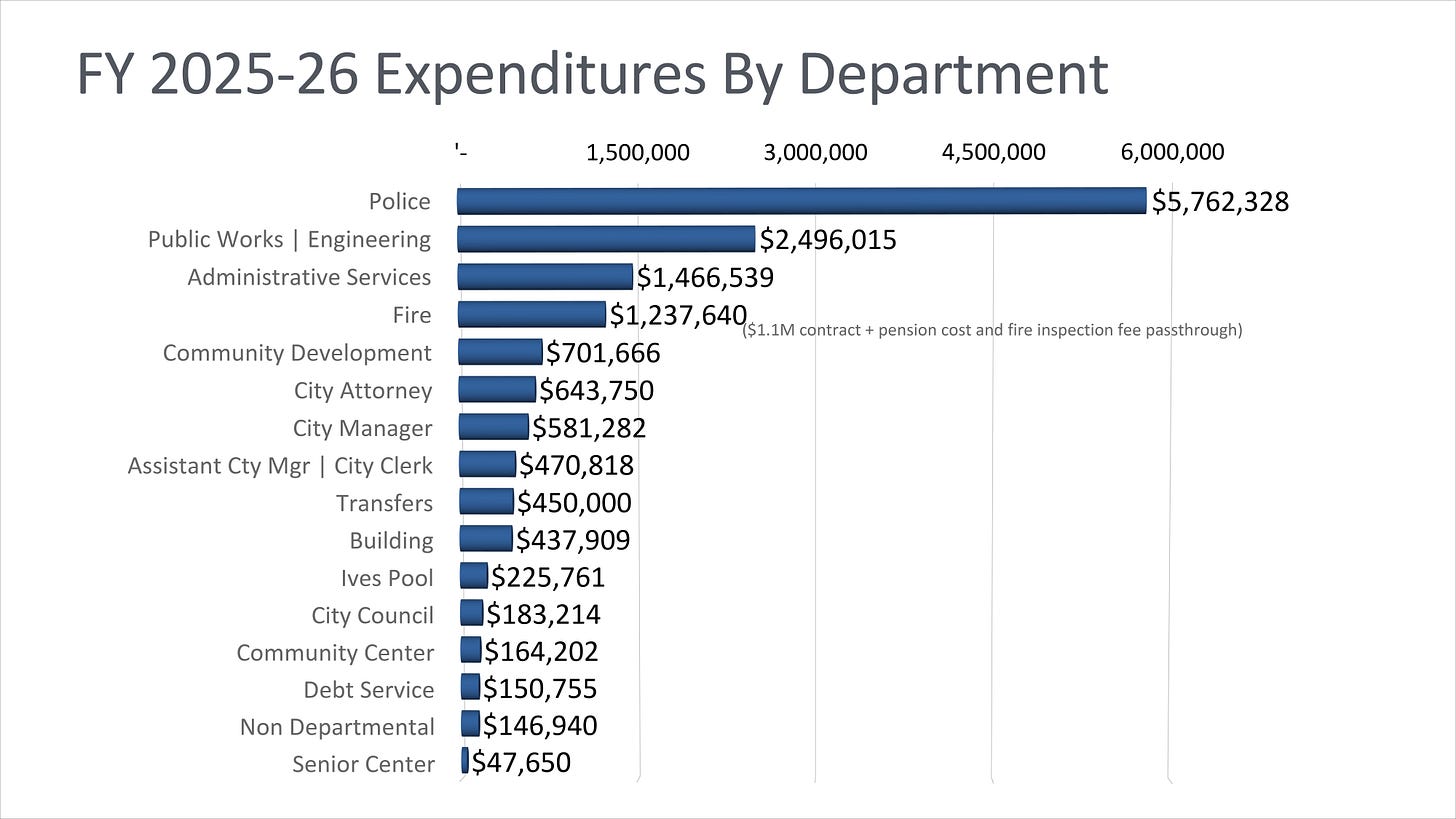

In total, Kwong said, looking across all city funds, the city is expected to bring in $32 million from property taxes from homes and businesses, sales taxes from stores and restaurants, water and sewer bills, building permits and fees, and state and federal grants. The city is scheduled to spend $29.1 million on the following: police and fire protection, roads and infrastructure, parks and recreation, city personnel costs and water and sewer services.

Fund by fund, that breaks down like so:

According to Kwong, the General Fund will have a reserve of 27.6%.

Here are a few of the reasons the budget is looking as healthy as it is.

Property taxes grew 5% on average.

Sales taxes increased 3% on average.

Revenue from Measure U

One-time planning and permit fees from the Barlow Hotel and the Canopy Project helped buoy the 2025-26 budget.

Here’s a quick look at departmental funding, which we’ll go into in greater detail in Part 2 of this article.

An obscure bureaucratic tool raises hackles and questions

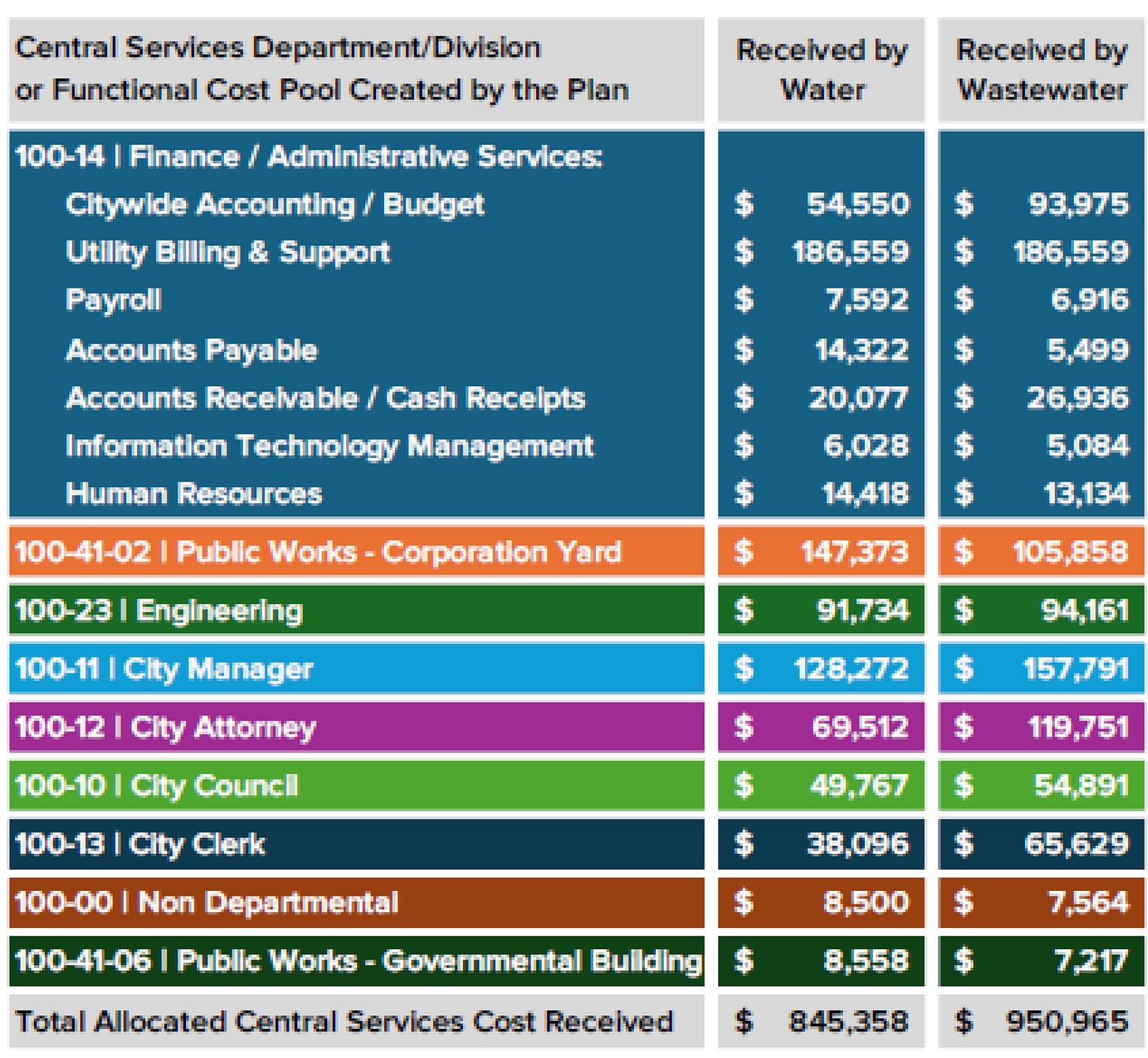

The most controversial part of the proposed budget overview involved the city’s cost allocation model, which is a method for distributing the costs of shared services—like administration and legal expenses—across different city departments. The questions from the public and council members involved the large amount of money that the city’s General Fund was receiving from the water and sewer departments.

For the upcoming year, according to a cost allocation model which was approved by the council in February 2024, the city will receive $845,358 from Water and $950,965 from Sewer. These payments helped buoy the bottom line of the city’s General Fund, but looking at them closely, councilmembers questioned why water and sewer were being asked to pay for services, which mostly didn’t apply to them.

“Why are the attorney fees so high, why are the city manager fees so high?” Vice Mayor McLewis asked. “I mean, there are so many different allocations here, and I understand that there’s a formula, but is that necessarily what we have to follow? The community needs to understand why this is costing so much. Is it possible that it could be lower? This has been an ongoing issue for the last several years over the allocation. I understand we had a formula. Do we necessarily have to follow that formula or can it be based on the cost that we might be able to project?”

Hinton pointed out that the city council cost seemed unreasonably high as well.

City consultant Terry Madsen of ClearSource argued, “The allocation of those costs is really a rational, reasonable allocation based on industry standards.” He said the formula used to figure these allocations was in line with how other communities did it. He also noted that the roughly $1.8 million cost to Water and Sewer for this year was $680,000 less than those departments had been charged previously.

That cut no mustard with the council

Councilmember Maurer noted that the city’s legal expenses were primarily concerned with the ongoing ACLU lawsuit, and she wondered whether that extraordinary cost could be deducted before the cost-allocation formula was applied.

In the end, the council decided to ask city staff to review the allocations and return with a report and suggestions.

You can watch a video of the June 17 Sebastopol City Council meeting here. The next Sebastopol City Council meeting is July 1, 6 pm, at the Sebastopol Youth Annex, 425 Morris St., Sebastopol, and on Zoom.

Very well written analysis of the meeting and the budget. I share your concerns about whether the different graphs represent the changes in assumptions. They did not share the actual budget sheets the graphs were produced from so we cannot check the work. When these graphs first appeared when Diana Rich was mayor, the sales tax and revenue assumptions were well under historical trends and expense increases were higher. The reserves plummeted and the result was declaration of a financial emergency. Now it is unclear what assumptions are being used for revenues or expenses. We don't know whether they are using the Barlow Hotel projections for TOT tax or something the city has developed independently. We don't know when the fees for building the hotel are budgeted, one might assume it will take longer than expected to start construction as they are still looking for financing. The Barlow assumptions for TOT tax and sales tax revenues were considered pretty rosy when they were shared several meetings ago. The danger here of course is that the council sees the rapidly rising reserves and doubles down on spending increases. I suspect the unions are eyeing those projections as well. It would be helpful for assumptions and data to be explicitly stated. I have a couple other comments...I will do another post for brevity.

I feel informed!