Poll results for sales tax measure

The city of Sebastopol paid for a poll asking people about increasing the sales tax by a quarter-cent or half-cent

The city of Sebastopol is considering putting a sales tax measure on the November 7th ballot this year to help close its $1.6 million budget deficit.

There is a special meeting tonight, Tuesday, August 8, at 6 pm, to discuss the details of this proposal. (Learn more.)

From July 22 to 25, consultants ran a telephone poll to gauge residents’ reactions to the idea of a rise in the sales tax. The results of that poll were released at the August 1 Sebastopol City Council meeting.

The polling results were introduced by Dennis Rosatti, whom the council had hired to manage the polling. Rosatti engaged the polling company, Smart Voter Contact, to do the actual polling and the firm, ForwardSupport, to analyze the resulting data.

Pollsters were looking for answers to several questions:

Would residents be more likely to vote for a quarter-cent or half-cent sales tax?

What did they want the city to spend the money on?

Did they have an opinion on whether or not to include a sunset clause in the measure?

Out of a total of 2,229 registered voters, pollsters contacted 799 people. Only 198 completed all the questions in the survey. The answers below are based on the answers of those 198 people.

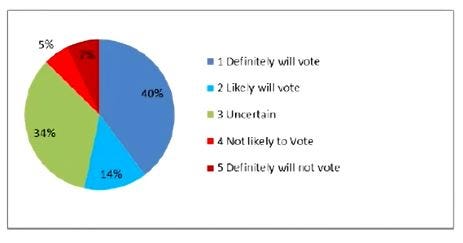

The poll had 11 questions. The first question asked, “If the city of Sebastopol places a special tax measure on the November 2023 ballot, how likely are you to cast a vote on that measure?”

Those that said they definitely would not vote in a special election were dropped from the sample.

A quarter-cent tax or a half-cent tax?

Questions 2 and 3 tested whether voters would prefer a half-cent or a quarter-cent sales tax. 59% said yes to a half-cent sales tax, which would raise approximately $1.5 million (almost enough to close the entire budget gap), while 56% preferred the quarter-cent sales tax option, which would raise just half that, roughly $750,000. Sixteen percent indicated they’d vote no on a half-cent sales tax, while 18% said they’d vote no on a quarter-cent sales tax. In both questions there was a large undecided percentage of 25-26%.

There is good news and bad news in these numbers for supporters of the sales tax. The good news is that a majority of voters would support either at half- or quarter-cent sales tax. The bad news is, because it’s a special election, the measure would have to pass by a two-thirds vote of 66.67%. The other good news, according to Rosatti, is that there is a large potential swing vote — that 25% undecided group.

“It really underscores in my mind that a robust public education campaign needs to happen,” Rosatti said.

On the face of it, the half-cent option seemed to have a slight edge, but Rosatti noted that the edge disappeared among voters who identified themselves as very likely to vote in the special election. Among these voters, the quarter-cent sales tax had a slight edge.

How should the money be spent?

The next group of questions focused on how the money raised in the measure should be spent. This is important because this sales tax would be considered a special tax, which has to be directed toward specific ends.

Rosatti also said that should a sales tax measure fail and the city be required to make further deep cuts, this data could serve as a guide to what citizens deemed important.

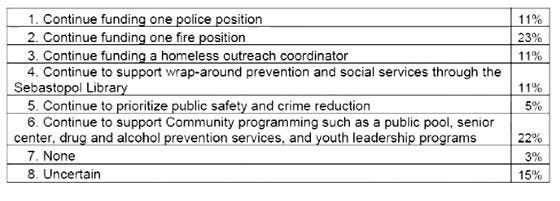

Question 4 asked, “Considering that the city needs to reduce reliance on the use of reserve funds, I am going to read you a list of specific city programs and I ask that you select which program you feel is most important to maintain in the budget.” The areas that found the greatest support were "continue funding one fire position" (23%) and "community programs such as a public pool, senior center, drug and alcohol prevention serves and youth leadership programs" (22%).

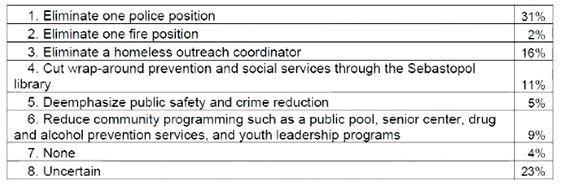

Question 5 asked what current programs should be cut. Interestingly the largest percentage (31%) wanted to cut one police position. This seems to fly in the face of the very low percentage of people (just 5%) who wanted the city to “deemphasize public safety and crime reduction.”

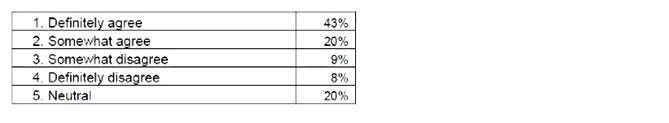

The next two questions tried to suss out which organization should provide “preventative services…for people experiencing and at risk for mental and behavioral health challenges.” Question 6 tried to gauge if people thought the police should provide such services, while Question 7 asked if people thought the library should provide such services. (This was clearly a bone thrown to Councilman Zollman, who at the last meeting, had expressed his desire to see the library to widen its mandate to include social services, as he said the city of Richmond has done.) The answer was a virtual tie, with 63% agreeing that these services should be provided the police and 64% agreeing these services should be provided by the library.

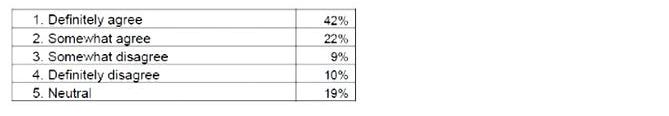

Q6: Looking at the priorities of city budgeting regarding prevention services, would you agree or disagree that a high priority should be put into expanding the preventative services provided by the Sebastopol Police Department for people experiencing and at risk for mental and behavioral health challenges?

Q7: Looking at the priorities of city budgeting regarding prevention services, would you agree or disagree that a high priority should be put into the preventative services operated through the Sebastopol Library for people experiencing and at risk for mental and behavioral health challenges?

Parks get the thumbs up

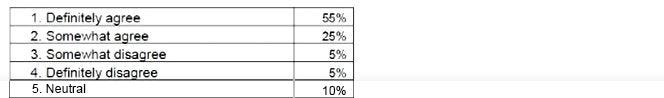

Question 8, about support for parks, found the most enthusiastic support, with 80% of respondents agreeing that they should have a high priority in the budget. (55% “definitely agree” plus 25% “somewhat agree” equals 80% agreement.)

Q8: Looking at the priorities of city budgeting regarding parks, would you agree or disagree that a high priority should be put into maintenance and programming for the City of Sebastopol Parks.

Again, quarter-cent or half-cent?

Now that participants had had a chance to think about a sales tax and what it might be spent on, pollsters asked them again about how they’d vote on each option. The numbers came back like so:

59% said they were likely to vote for a half-cent sales tax, while 18% said they were likely to vote against it. The undecideds dropped to 16%.

59% said they’d vote for a quarter-cent sales tax, 22% said they’d vote against it, and 19% were undecided.

Among those who said they were definitely going to vote in the special election, 68% said they’d vote for a quarter-cent sales tax, while 65% said they’d vote for a half-cent sales tax.

These numbers, combined with the fact that increasing the sales tax by half a cent would give Sebastopol the highest sales tax in the county, led the election consultants (and the majority of the council) to recommend a quarter-cent sales tax option.

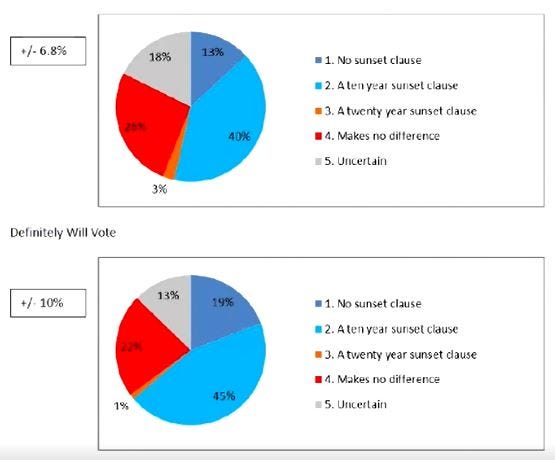

A Sunset Clause?

The final question in the poll asked whether people wanted a sunset clause in the measure—that is, whether they wanted this sales tax to be terminated after a given time period. 40% of those polled (and 45% of likely voters) said they’d like a 10-year sunset clause. 25% said a sunset clause would make no difference in how they voted.

In Summary

Rosatti summarized the poll finding this way: “It were put to a vote today with no campaign in favor or opposed, it is likely that a quarter-cent sales tax would receive a two-thirds vote, however support is soft enough that an opposition campaign could easily erode that support to below a two-thirds majority—and that is a statement coming directly from our pollster analyst,” he said.

“Support for the quarter-cent sales tax is unsteady,” he said. “This points to the need for a robust public education campaign, and as I said, for a separate ballot measure campaign as necessary for passage to gain a two thirds majority.”

Though the city must pay to put the initiative on the ballot, it is not allowed to fund the ballot measure campaign. This must be done independently. It is allowed, however, to create an informational campaign to educate voters about the financial plight of the city.

Tune in tonight for more discussion of this issue at this week’s special city council meeting. There’s a lot more to say on this issue, but we are going to press with this short summary to prepare readers for tonight’s discussion. Look for a report on reactions to this poll and the suggested quarter-cent tax in an upcoming city council recap.