Sebastopol City Council approves ADU condo conversions, but that's just the beginning

The Sebastopol City Council gave property owners the right to sell their ADUs as condominiums, but the road to doing so—for the city and the homeowner—is long, complex and expensive

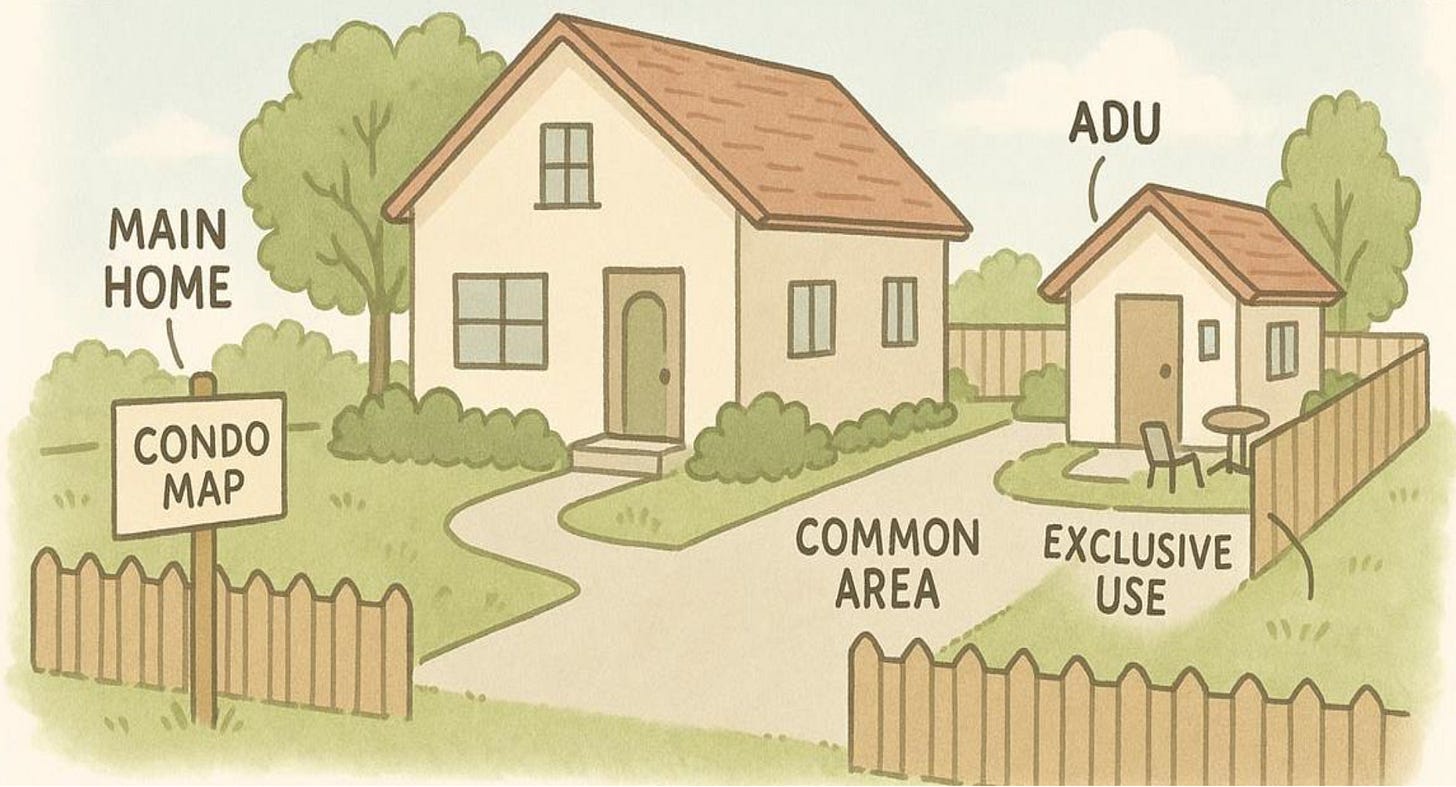

The state has passed a slew of laws over the last few years to increase the number of homes available to own or rent in California. One of these, AB 1033, allows homeowners to sell both ADUs (accessory dwelling units) and in-home JADUs (Junior ADUs) as condominiums—but only if their local municipality opts in.

At the council meeting on Tuesday, the City of Sebastopol did just that. As a part of a broader zoning update, the Sebastopol City Council voted 4 to 1 (Mayor Jill McLewis dissenting) to opt in to AB 1033.

This move opens new financial opportunities for Sebastopol homeowners and expands the availability of affordable housing, including starter homes for young adults and small, more affordable homes for seniors looking to downsize.

Assembly Bill 1033 was introduced by former Assemblymember Phil Ting, who represented San Francisco and the Peninsula. It was signed into law in 2023 and went into effect in January 2024.

Sebastopol is the first city in Sonoma County to opt in to AB 1033. Other cities that have opted in include San Francisco, San Jose, San Diego, Santa Monica, and Santa Cruz. It’s pending in the cities of Berkeley, Napa, Mountain View and in the county of San Diego. As you can tell from this list, these are some of the most expensive places to live in California—places where the housing affordability crisis is particularly acute.

Councilmember Phill Carter has been a long-time advocate of using ADUs to increase housing stock and create more affordable housing options.

“I campaigned on this issue and worked to implement it,” he said. “AB 1033 creates a legal right for homeowners to sell their ADU (accessory dwelling unit) separately from their primary residence by converting the property into condominiums. Before this law, ADUs had to stay with the main house—you couldn’t split them off and sell separately.”

“Imagine, older homeowners can unlock $300,000 or more in equity—without moving,” he said.

Carter said this change will also benefit the city’s bottom line.

“Improving the budget for the long term has been one of my core goals as a council member,” said Carter, who is a member of the city’s Budget Committee. “Property taxes are about 25% of our city’s yearly income, more in years without large developments...New small ADUs valued at $300,000 and up will generate meaningful property taxes year after year.”

In addition, Carter said that, ideally, “Infill uses infrastructure we’ve already paid for—water, sewer, roads, so it adds money to repair budgets.”

This may be less true in the case of Sebastopol, where the roads and water and sewer systems are in dire need of repair. It was exactly this point that pushed Mayor Jill McLewis to vote against this amendment to Sebastopol’s zoning law. State law currently prohibits cities from charging impact fees for ADUs under 750 square feet, while requiring proportional fees for larger units.

“We just have infrastructure that’s crumbling everywhere,” she said. “So to me, it just feels irresponsible to vote for something like this. It feels hastily put together. Other cities have adopted this. Why don’t we know what the impact fees are? I personally have never been supportive of having ADUs that didn’t pay impact fees, because everyone who lives here has an impact on our water, sewer, all the different things that we all have to have in order to live here.”

Jen Klose of Generation Housing, a housing advocacy group, dismisses this concern. “It’s sort of missing the point that an in-perpetuity income stream [from property taxes] is going to dwarf any kind of one-time impact fee.”

Opting in is just the beginning

Opting in to AB 1033 is just the first step. Implementation of the measure is left up to the cities and counties that opt in.

“Here's the critical piece many people miss: AB 1033 creates the right, but cities must create the actual process,” Carter said. “AB 1033 doesn’t provide an application form. It doesn’t include template documents. It doesn’t specify the review process. It doesn’t set timelines,” Carter said. “Until a city adopts an implementing ordinance, homeowners literally cannot apply because there's no form to fill out, no fee structure, no defined process.”

The city has to develop all of these, but it doesn’t have to reinvent the wheel, Carter said. It can copy from what other cities have done and then customize those documents to fit Sebastopol’s needs.

Carter laid out what the city must do next:

Basic implementation (minimal compliance with AB 1033):

Adopt ordinance establishing AB 1033 process

Create application form listing requirements

Set processing fee ($500-$1,500)

Establish review timeline for approval (typically 30-60 days)

The burden on homeowners

Once the city creates a pathway, the legal burden of actually creating a condominium falls to the homeowner. It isn’t a piece of cake. AB 1033 requires that homeowners adhere to the Davis-Stirling Common Interest Development Act, which requires, among other things, the establishment of a homeowners’ association (HOA), drafting of governing documents, and ensuring shared financial accountability for maintenance and repair of common areas.

Here’s Councilmember Carter’s estimate of what this would cost:

What homeowners still need to hire professionals for:

Licensed surveyor ($2,000-$5,000)

Real estate attorney for CC&Rs - Covenants, Conditions & Restrictions ($3,000-$8,000) [According to Nolo Press, “An HOA’s “Covenants, Conditions, and Restrictions” (CC&Rs) is a legal document that describes what you can and can’t do with your home.”]

Title work and recording fees ($1,000-3,000)

Potentially utility separation costs (varies widely)

Total typical cost: $10,000-$20,000

Carter said the city could reduce this burden by providing template CC&Rs that have been pre-approved by the city attorney. He said this could reduce the cost of this step by 60 to 70%.

At the Jan. 6 council meeting, Sebastopol Planning Director Jane Riley said, “My personal opinion is, as long as the state requires that there needs to be a homeowners association, there aren’t going to be a lot of people who want to take this on. But I do think that the state someday will reduce that requirement.”

Klose of Generation Housing thinks this is overly pessimistic. “I don’t see it as a hurdle,” she said.

In fact, she sees it as a feature, not a bug of AB 1033—a way to keep shared properties from going off the rails.

“There is actually a benefit to the HOA statute,” she said. “Even though our California HOA statutes are a little bit exacting, they do give you a template to follow, and they give you a way to do conflict resolution. They require that you have that, as well as allowing some real flexibility to create that HOA and how those work. And so it’s really just putting an already codified template into place on how to manage the agreements that have to be made in order to make something like this work.”

Still, it’s not for the faint of heart. According to a report by Abodu, a firm that builds ADUs, the condo conversion process under AB 1033 requires five key steps:

Certificate of Occupancy first. The ADU must receive a COO before the condo map can be filed. You cannot run permitting and condo mapping in parallel.

Lienholder consent. Every lender on the property must provide written consent before you can record the condo map.

Condominium plan. The plan must comply with the Subdivision Map Act and local subdivision ordinances.

Davis-Stirling compliance. You must establish a homeowners association governing shared spaces.

County recorder filing. All documents must be recorded before the sale can close.

What’s happening at the county level?

If you don’t live in Sebastopol proper, you might be wondering if AB 1033 applies in unincorporated areas of the county. The answer is no, it does not—at least, not yet.

Permit Sonoma Program Manager Genevieve Bertone passed along this information:

The County has not yet opted in to implement AB 1033, as recent housing updates have been focused on maintaining compliance with evolving mandatory State laws. However, some interest has been expressed by the Board of Supervisors as well as community advocates for affordable housing. We will continue to monitor how other jurisdictions handle implementation of AB 1033, which may inform future endeavors if directed by the Board.

On 12/9/2025, the Board of Supervisors adopted new ADU and JADU regulations that reduce restrictions and provide more flexibility to homeowners to encourage ADU production and retention. Key amendments to ADU and JADU provisions include:

Allowing up to two ADUs on single-family lots to be of any configuration (attached, detached, or conversion)

Allowing ADUs on multifamily lots to be either attached or detached

Elimination of parking requirements for ADUs

Reduction of front setback and lot coverage standard applicability to ADUs

Increase to the maximum allowable height for ADUs

Clarification of permitting requirements for new ADUs and JADUs and for unpermitted ADUs and JADUs constructed prior to 2020

5th District Supervisor Lynda Hopkins said the question of opting in to AB 1033 is already on her radar.

“Diversifying our housing stock is essential, and I remain a strong advocate for affordable housing solutions and ADUs,” she said “In my role as Board Chair, I asked Permit Sonoma to monitor how this policy is being implemented across California for possible consideration by the Board. I’ll be checking in at our February calendaring meeting for an update as to when this can be brought forward for County consideration.”

The economics of an ADU might be an issue. Council member Carter stated a homeowner could free up $300,000 by building an ADU and selling it as a condo. Building an ADU in Sonoma County is estimated to cost $250 to $400 per square foot. Range depends on finish levels. For 800 square feet costs would be $200,000 to $320,000. Architectural plans, site preparation, permits and the cost of creating a homeowners association will be added to construction costs. For the homeowner to “free up” $300,000 the unit would have to sell for $500,000 to $650,000.

Nothing wrong with the goal of more affordable housing. Concerned the city is on the leading edge of yet another initiative only adopted by large cities with fully staffed housing authorities to implement. Also another initiative no one on council or city staff understands. Mayor McLewis was correct in voting against a haphazardly constructed program. No homeowner alone can do this without guidance. Some will pay a lawyer, others will just call city hall. How much staff time is council member Carter proposing to dedicate to this. The economics are a little sketchy as well. Carter said could release $300,000 in equity. Given the very small lots in Sebastopol, adding another occupied dwelling not owned or controlled by the original homeowner might actually lower the value of the original home by more than $300,000. It might lower value of neighbors properties. It’s a new idea, no precedents. Early adopters will find out how well our politicians did crafting the program.