The lowdown on the city budget, Part 1

Two lengthy presentations at the March 19 Sebastopol City Council meeting offer clarity about the city's budget woes and a possible path to solvency

The March 19 Sebastopol City Council was completely given over to a discussion of the city’s budget problems. Two presentations—one by an accounting consultant and one by City Manager Don Schwartz—offered clear and understandable descriptions of the city’s current financial dilemma and, more important, plausible paths to a solution. This article will summarize the first presentation. Part 2, which we’ll publish on Tuesday, will discuss Schwartz’s presentation.

The scope of the problem

There are regular complaints from citizens about the city’s frequent use of consultants, but accounting consultant Bob Leland of Baker-Tilly did a masterful job of delineating the city’s current condition. Baker Tilly is the 10th largest accounting/consulting firm in the U.S. and they work with local governments nationwide, including all the 20 largest California cities. In other words, Don Schwartz thought it was time to bring in the big guns.

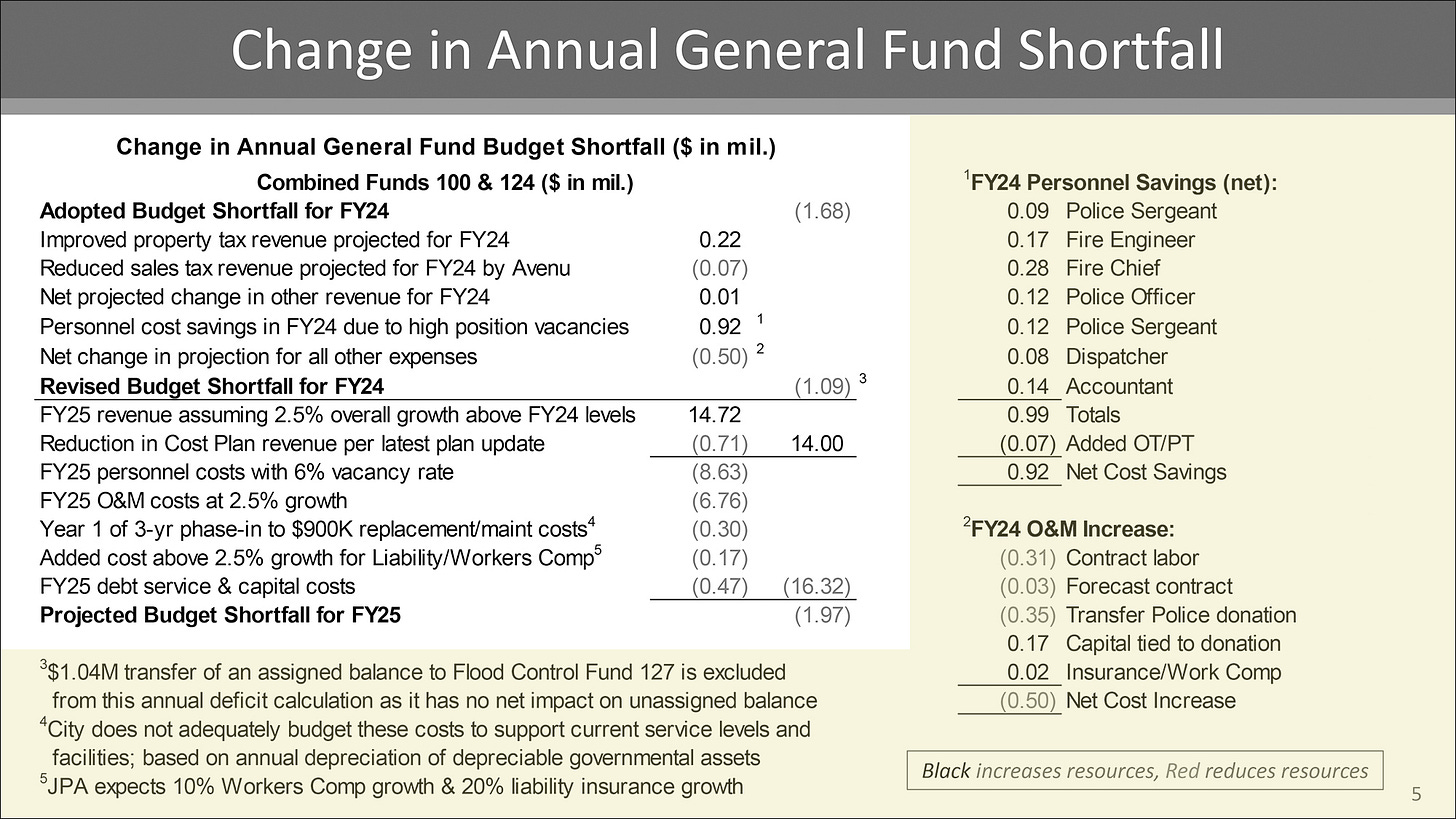

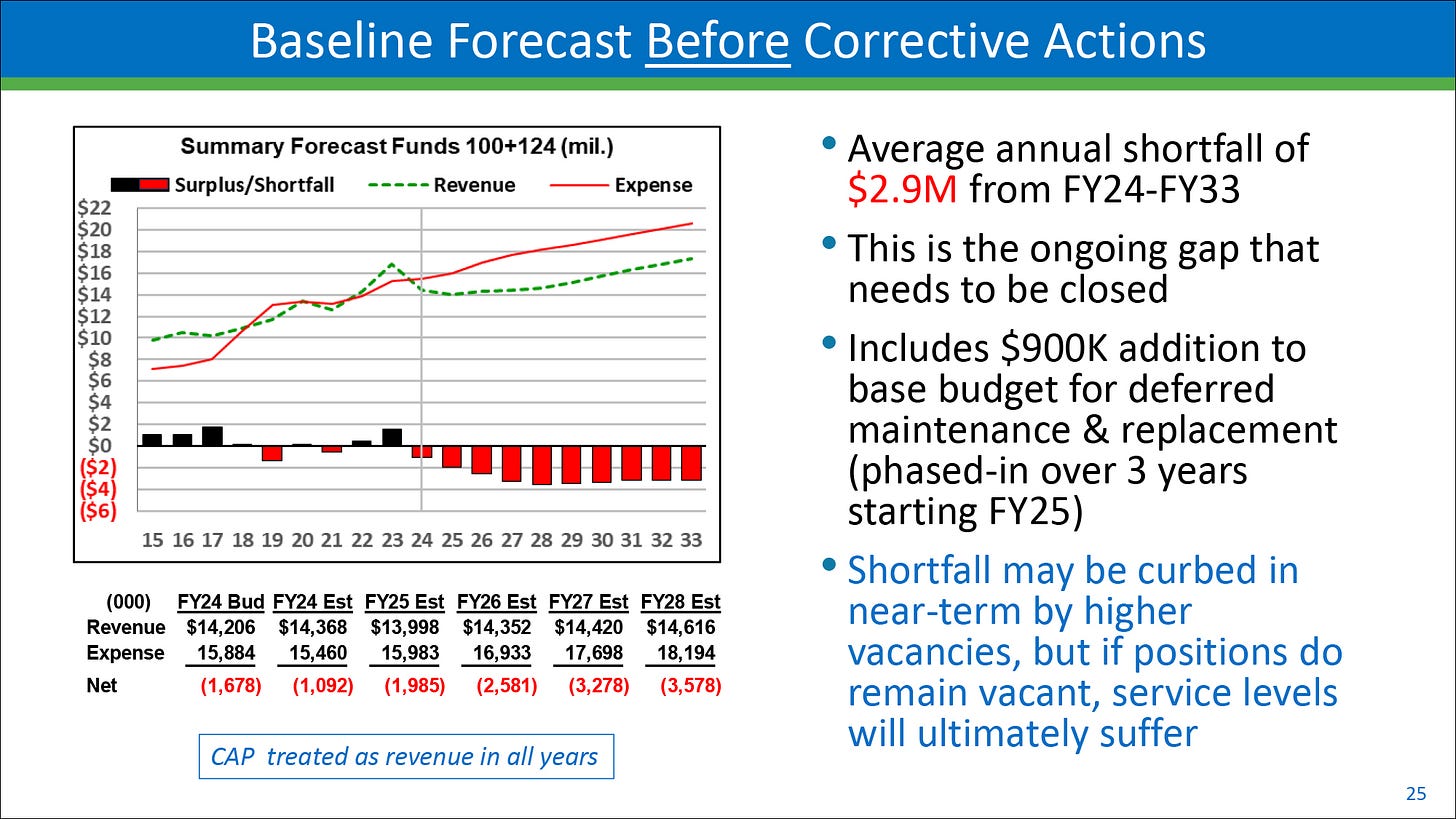

Leland’s analysis of the budget found that the city will be in deficit for approximately $1.1 million by June 2024, and $1.97 million for fiscal year 2024-2025. (Part of the higher deficit for 24-25 is a $300,000 paydown on the $900,000 of replacement and maintenance costs that the city is currently not spending, but that Baker Tilly thinks it should be spending to keep the city’s infrastructure in decent shape.)

Leland then compared how the city budgets for the last several years (2018 to 2024) aligned with actual spending. Mostly they tracked fairly well, and often spending was under the budgeted amount. The one exception was unbudgeted Transfers Out for programs not in the budget, which Leland said was an area of concern.

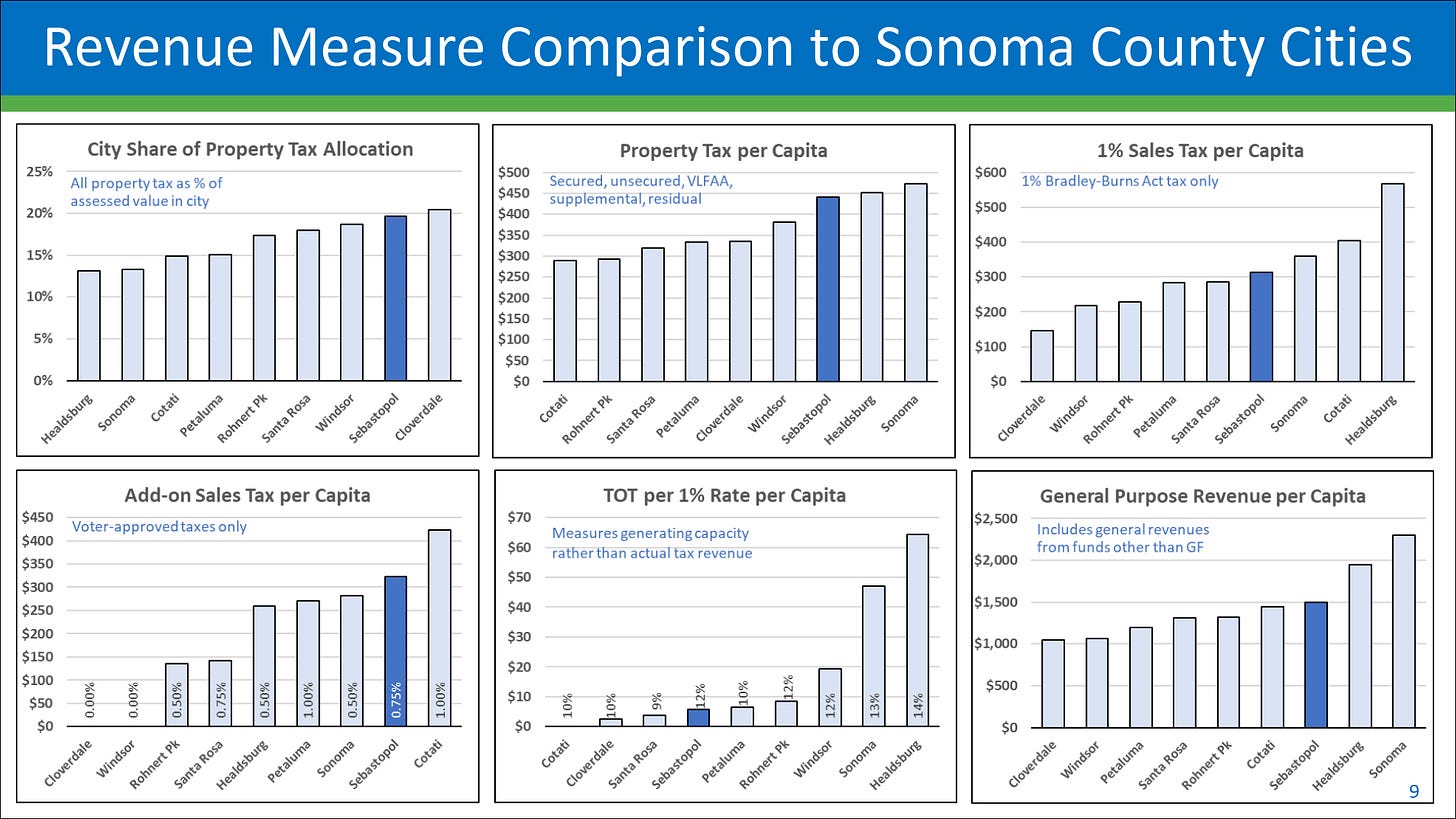

In terms of revenue, Sebastopol stacks up pretty well compared to neighboring cities, with the exception of its transient occupancy tax (TOT), a hotel tax.

Sebastopol now only has one hotel: the Fairfield Inn and Suites. Public commenter Kate Haug took Supervisor Linda Hopkins to task for taking Sebastopol’s only other hotel, the Sebastopol Inn, for homeless housing, depriving the city of needed TOT revenue.

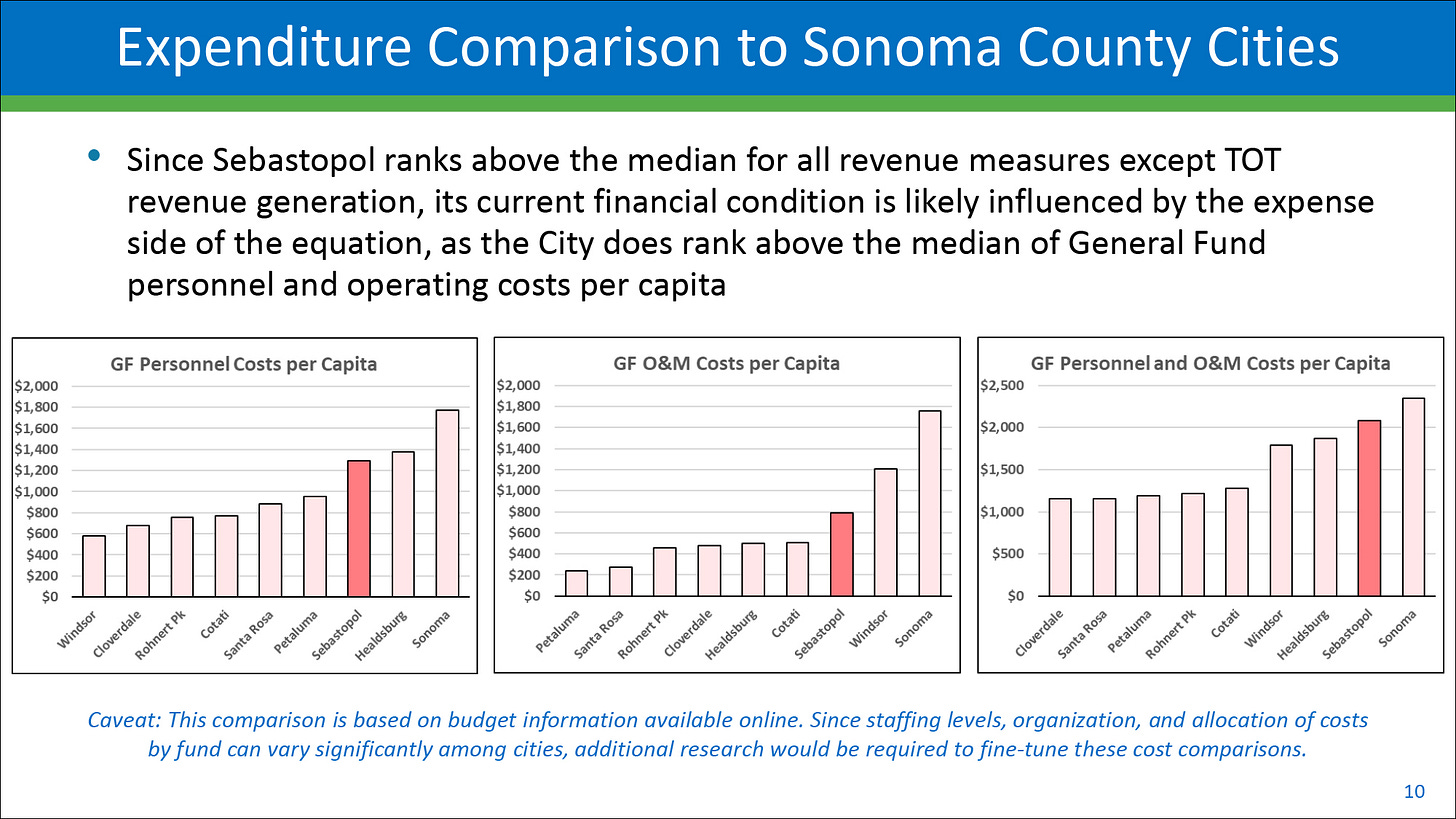

Because Sebastopol is doing pretty well with revenue measures, Leland said the city’s current financial condition is likely influenced by the expense side of the equation. He offered a comparison of how Sebastopol’s expenditures stack up next to neighboring cities.

City Manager Don Schwartz noted afterward that cities at the lower end of the expenditure scale are served not by their own city fire departments, but by local fire districts.

Leland then looked at broader economic trends: the history of recessions and current economic indicators, the latter of which looked rather favorable. Schwartz summed it up this way: “My bottom line takeaway is that we have significant financial challenges, and it’s not the economy.”

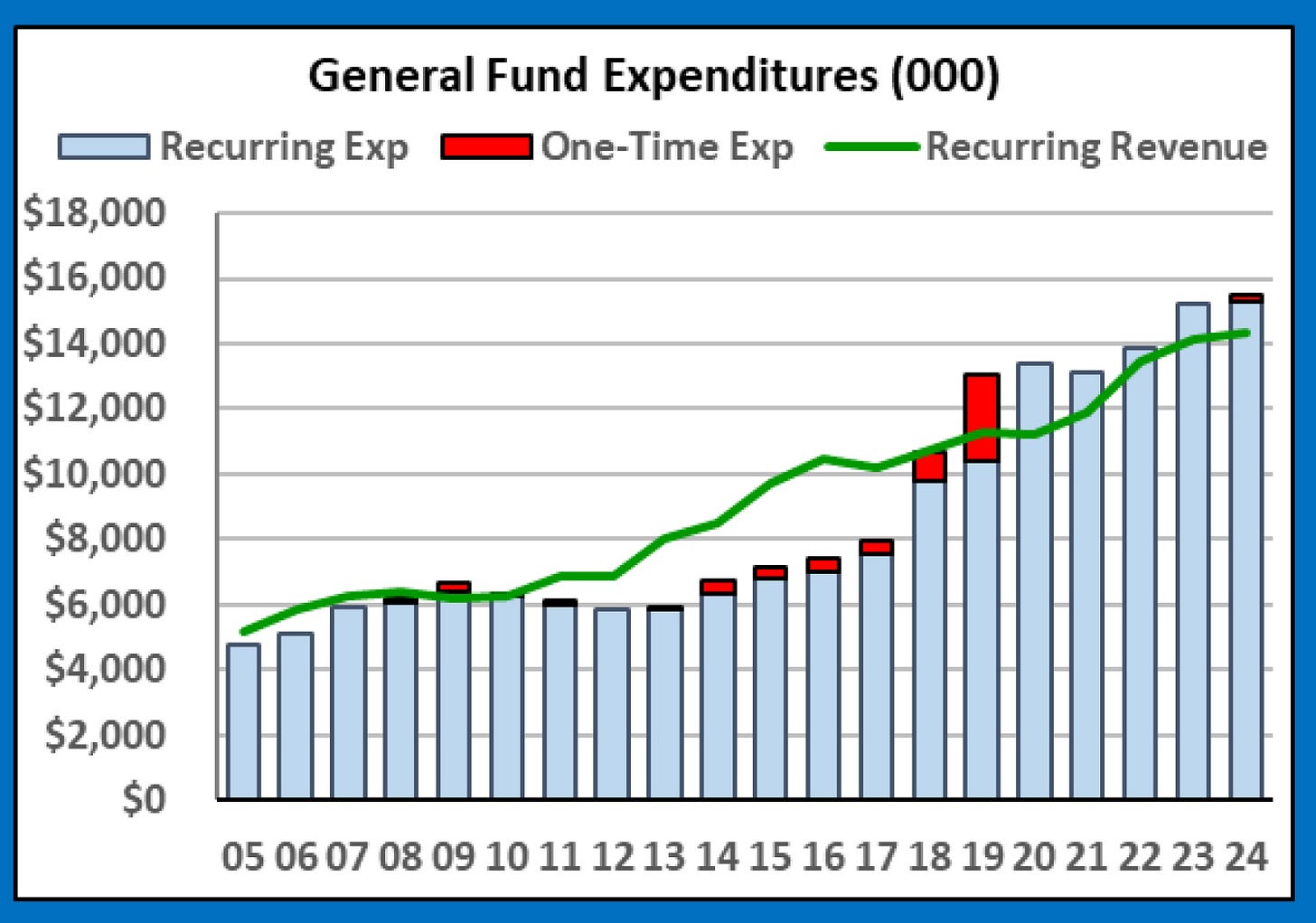

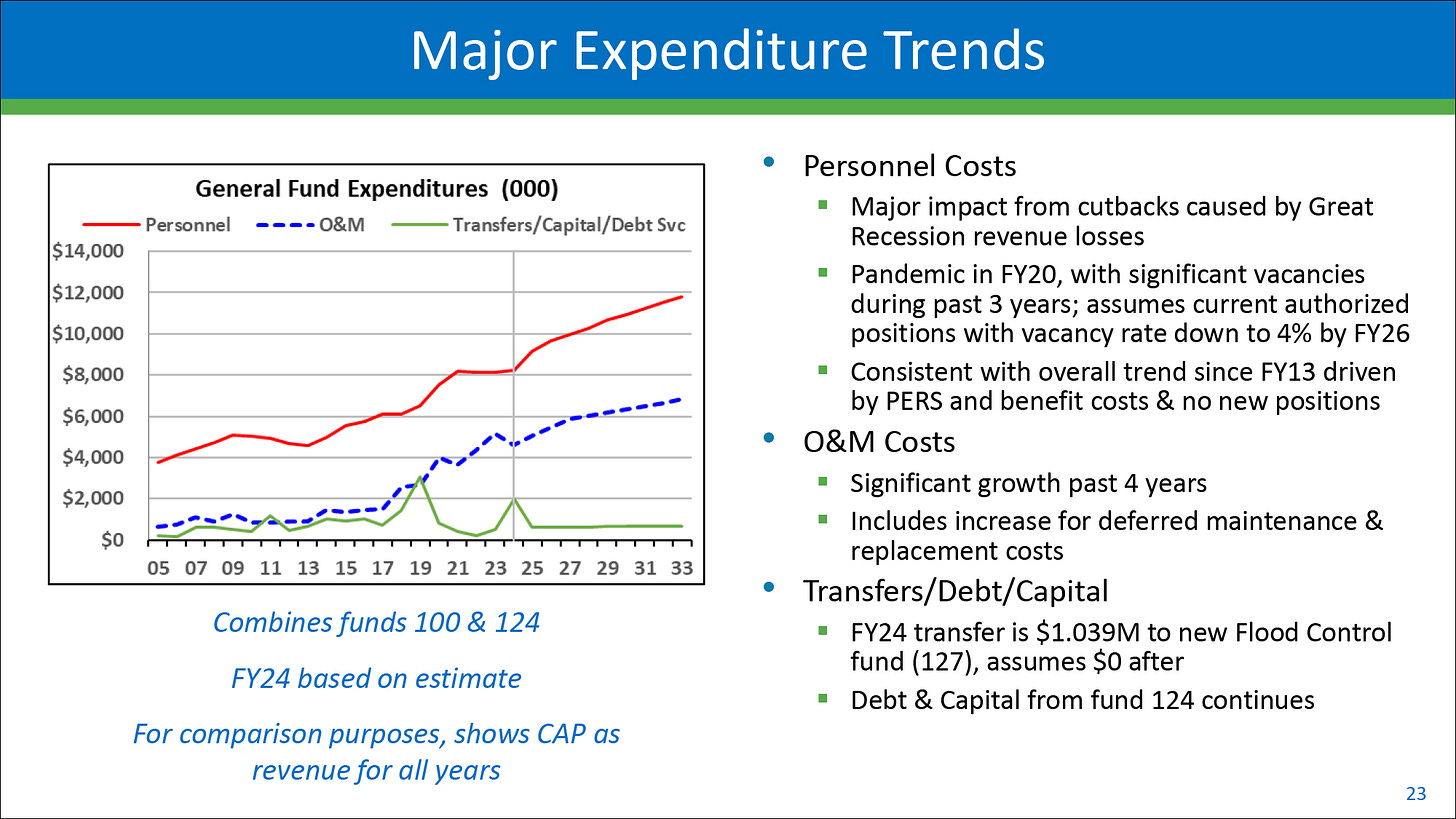

Here’s a look at the rise in general fund expenditures over several years.

The green line in the table above is recurring revenue. “You can see that before 2018, recurring revenue was more than was being spent, but that after 2019, recurring revenue was less than was being spent,” Leland said.

He then showed inflation charts—the jump in spending preceded the jump in inflation. He also suggested that funding city employees’ pension plans became more expensive due to a decline in the rate of growth of CalPERS investments.

Here’s how that expenditure increase breaks down:

The rise in expenditures and the relatively slower rise in revenue is a recipe for disaster. While we’re looking at a $1.1 million shortfall this year, the average shortfall for every year over the next eight years is $2.9 million on average.

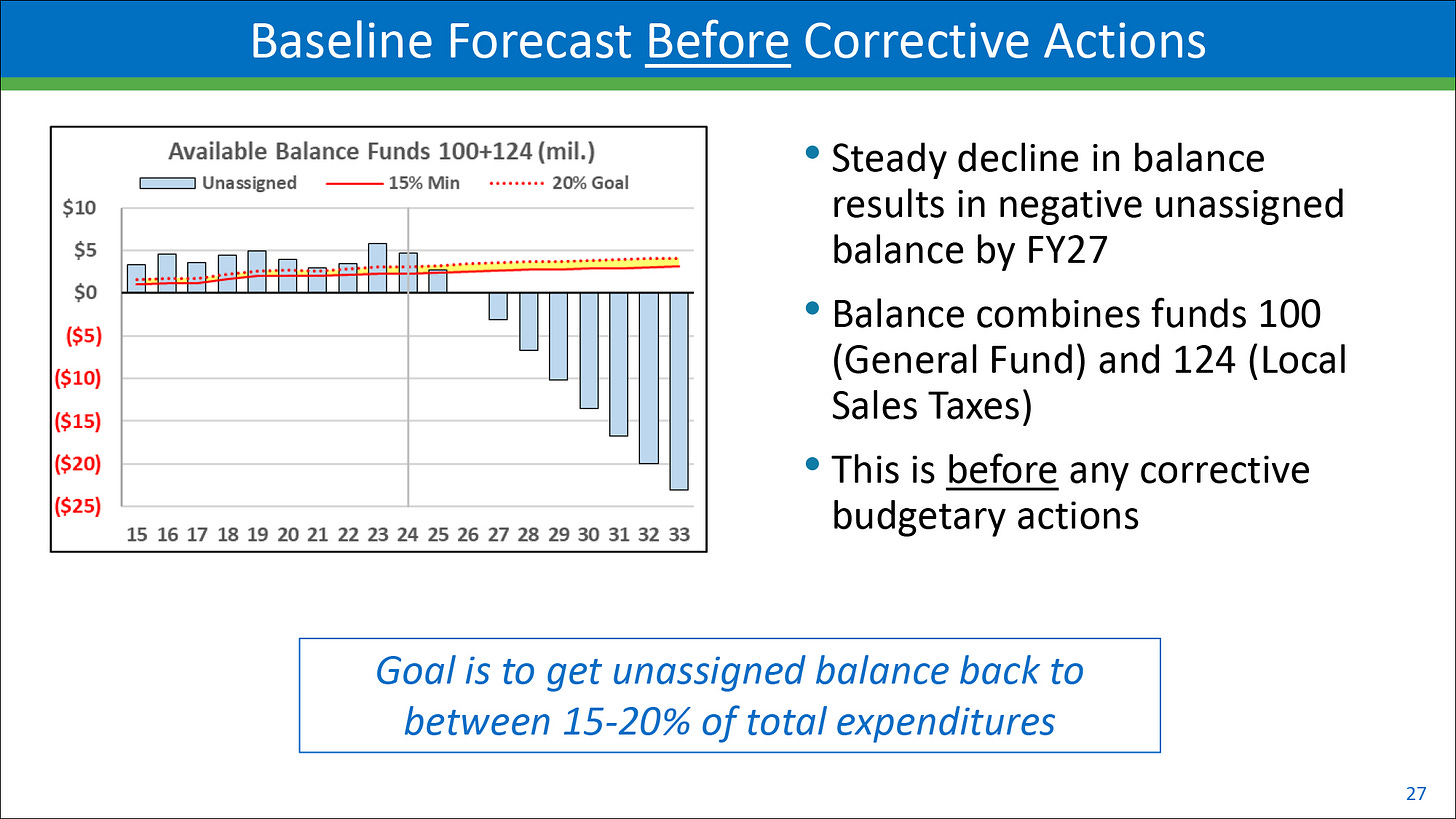

These deficits will result in a negative fund balance by 2027, which will steadily worsen. This is untenable and would end in bankruptcy, unless the city can turn things around.

A possible path to solvency

The solutions Leland offered were solutions we’ve seen before, but the council, including those who doubted these grim numbers in the past, seemed more in a mood to listen.

One thing was clear: there is going to be no magic bullet. It’s going to a take a combination of solutions—of all different sorts—to bridge the gap, and it’s not going to be pretty.

“There are paths or options that can get us back on solid financial ground,” Schwartz said after the meeting, “But they will not be easy, whether they include budget cuts or new revenues or a combination of the two.”

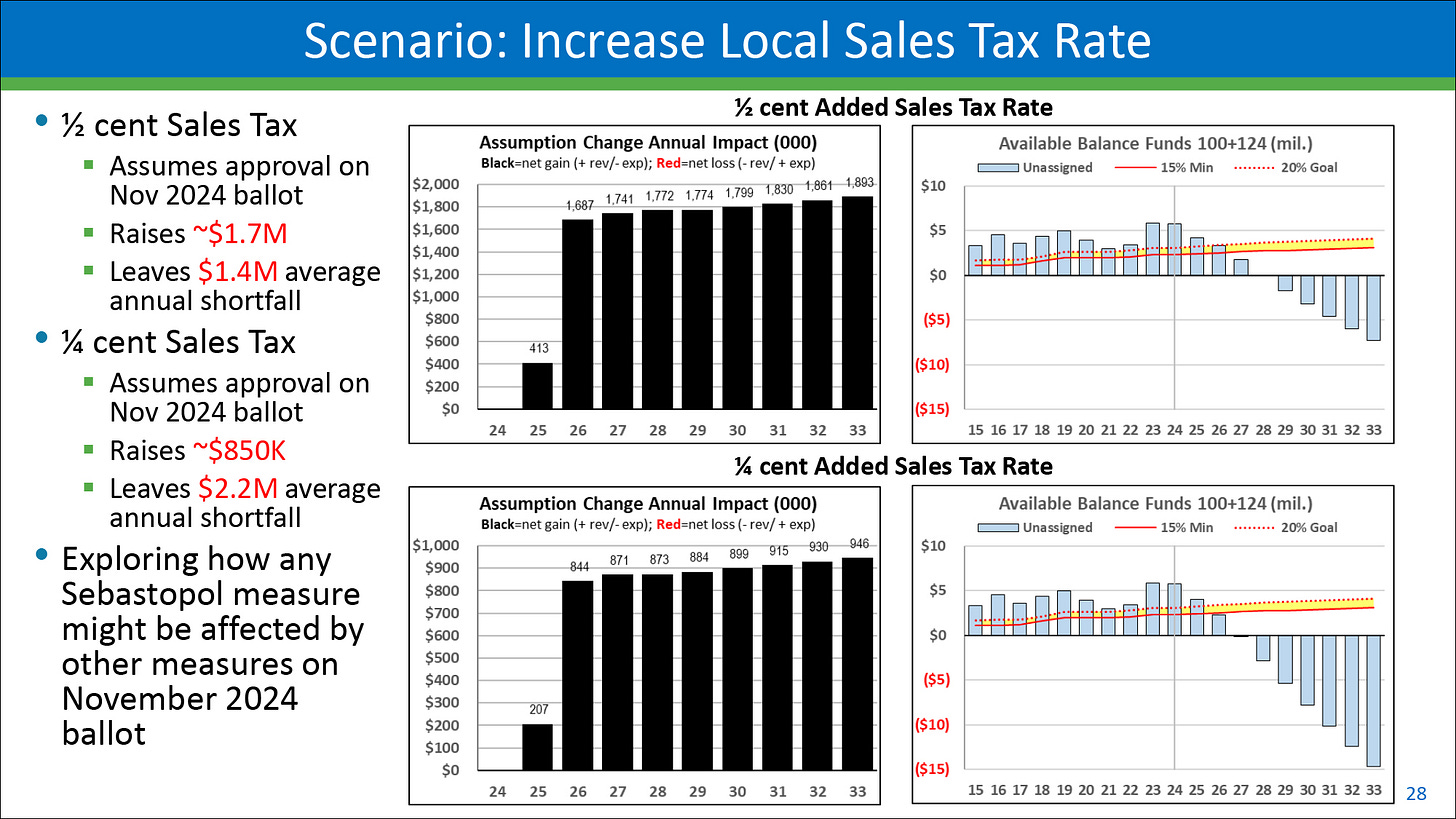

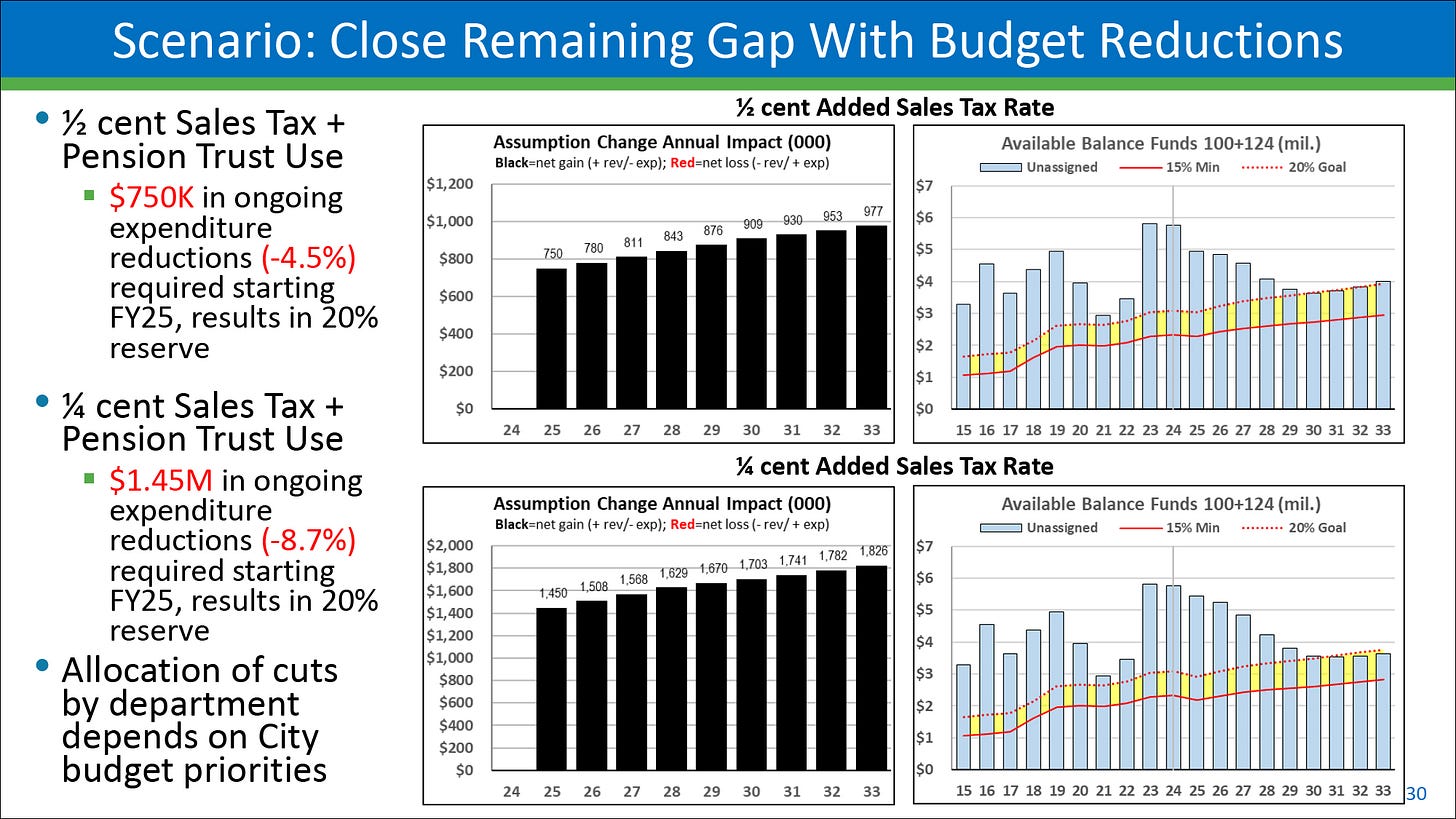

SALES TAX: Leland’s first suggestion was a 1/2 cent or 1/4 cent sales tax. A 1/2 cent sales tax would raise $1.7 million dollars, leaving a $1.4 million gap to close. A 1/4 cent sales tax would raise $850,000, leaving a $2.2 million funding gap. Sebastopol’s ability to raise the sales tax could be affected by the success of other sales tax measures, like the Measure H fire tax that just passed this month or the child care sales tax that will be on the ballot this November. That’s because the state of California has a sales tax cap of 10.25% and, with a sales tax at 9.25%, Sebastopol is already close to that number. Schwartz said there may be some wiggle room on that cap — and indeed some other cities in California have gone as high as 10.75%.

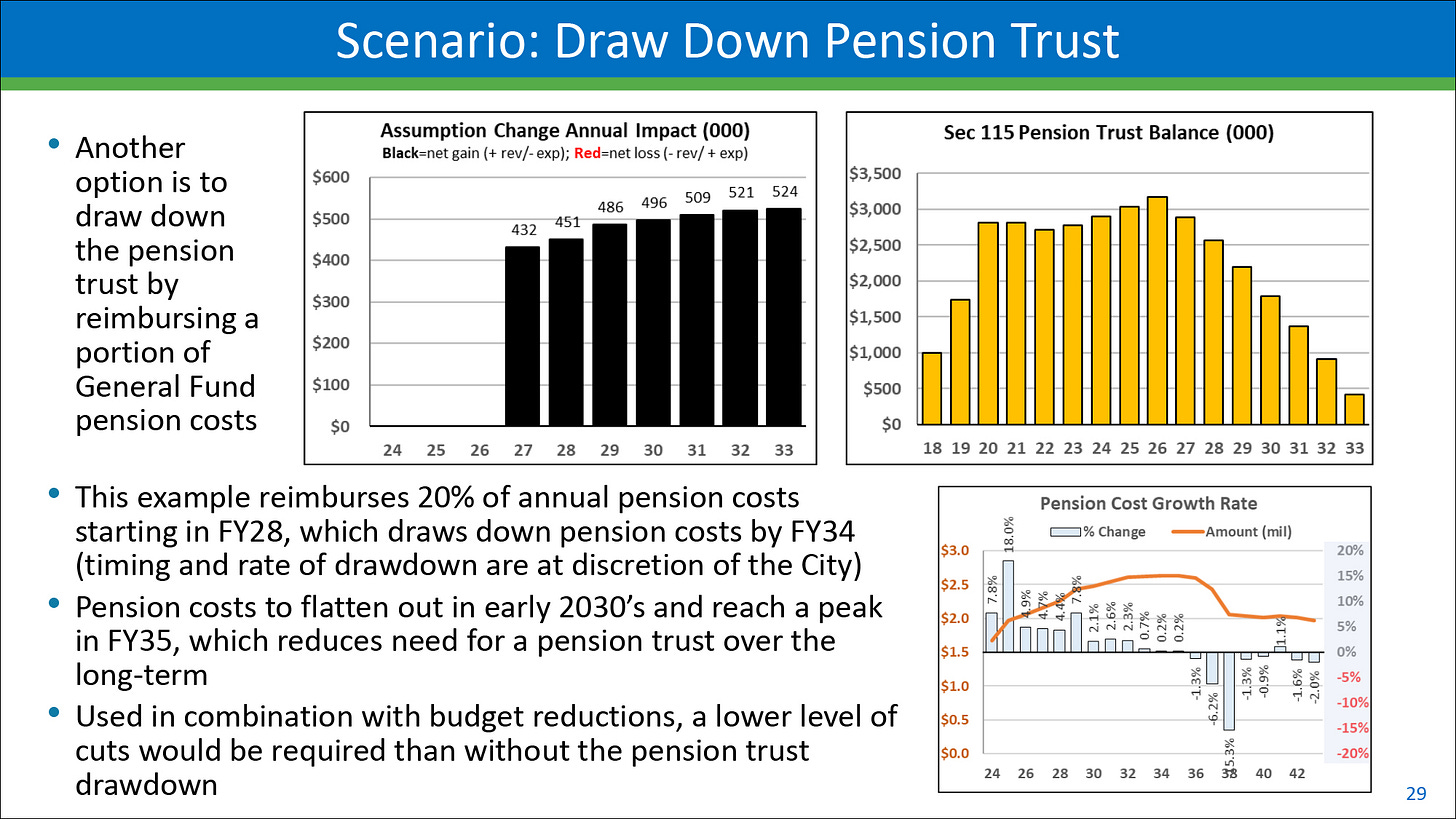

PENSION DRAW DOWN. The city has done a pretty good job socking away funds for future pensions. As a result, another option is to draw down the pension trust and use the funds to reimburse a portion of the General Fund’s mandated pension payments. (This sounds a little like robbing Peter to pay, er, Peter, but it actually works because it reduces the amount of money that will have to be paid out of the General Fund.)

CLOSE THE REMAINING GAP WITH BUDGET REDUCTIONS: This is where the rubber meets the road. Alas, there were few details in Leland’s presentation about how this might be done.

He also lists two other possible revenue enhancements: An increase in the 3.75% Utility Users Tax (UUT) rate to 5% on the November 2026 ballot would generate and additional $330,000 annually. An increase in the 12% TOT rate to 14% on the November 2026 ballot would generate $90,000 annually. This estimate is based on the city’s current hotel plus private rentals. Should the long awaited Hotel Sebastopol ever appear, that would bring in even more TOT money for the city, but at this point, no one is holding their breath on that eventuality—though the hotel’s developers still say they’re committed to building it.

NEXT STEPS: After reviewing the various possibilities, Leland laid out the following next steps for the city council:

Agree on key baseline model assumptions: $900K added for deferred maintenance/replacement, 2.5% COLAs (cost of living adjustments), zero FTE growth (which means a moratorium on hiring for new positions).

Decide on a sales tax measure for the November 2024 ballot: ¼ cent versus ½ cent tax

Review other revenue increases and expenditure reductions for closing the remainder of the structural deficit.

Figure out how to address unmet capital needs, such as street repair, which may require a parcel tax or general obligation bond.

Attract more visitors, in part through the development of new hotels.

This is great as far as it goes—if the council actually acts on it—but the question that didn’t get answered is this: How did the city get in this perilous position in the first place? At the end of the evening, during public comment, Steve Pierce asked this very question. He told the council that before they go asking the citizenry for more money—which he supports—they better come up with a darned good answer to that question because people will want to know.

Watch the March 19 city council meeting here.

Excellent reporting! Thanks so much for your work!

You’ve done an amazing job of making a complex issue comprehensible. Thank you.