What we learned at this week's town halls

Citizens got a chance to ask questions, and the city got a chance to get the word out about the budget crisis and clear up some misinformation

This is a two-part article on this week’s town halls. In Part 1, we’ll summarize the initial presentation that kicked off both town halls and include some questions from the in-person town hall. In Part 2, we’ll hear questions and answers from the Zoom town hall.

The city of Sebastopol sponsored two town halls this week: a Zoom town hall on Monday and an in-person town hall on Wednesday. Over 100 people participated in the Zoom town hall, while roughly 50 people came out for the in-person event.

Given how contentious the last few council meetings have been, the mood at the town halls was remarkably positive, despite the grim financial news the city had to deliver. People seemed relieved to have a chance to ask their questions and get them answered by a panel of city experts, including city manager Don Schwartz, Police Chief Ron Nelson, Public Work’s Dante de Prete, Senior Building Inspector Steve Brown and, of course, City Clerk and Assistant City Manager Mary Gourley.

Both town halls began with a presentation by Robb Korinke, a consultant from GrassrootsLab, a Southern California public relations firm that specializes in community engagement, online organizing, coalition building and research.

A portrait of city government

The presentation painted a portrait of the city government and laid out the town’s current financial situation. It began by discussing city services:

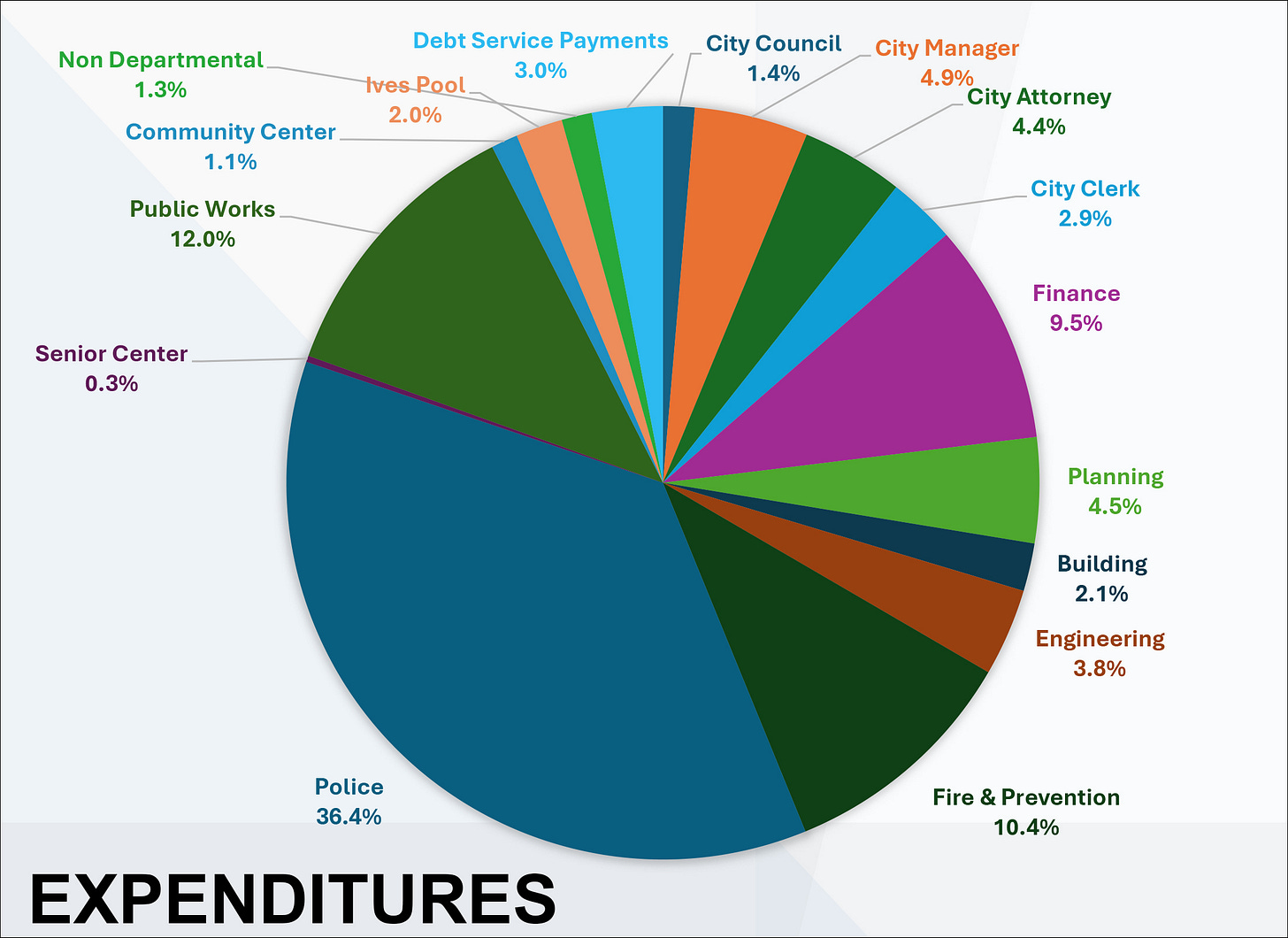

POLICE: Sebastopol has 12 full time sworn police officers. In 2023, there were 12,384 calls for service, an increase of 4,641 from the prior year. Policing accounts for 36.4% of the city budget.

FIRE: The Sebastopol Fire Department has two paid firefighters and 31 stipend volunteer fire fighters, who collectively responded to 1,325 calls in 2023, a 30% increase from a decade ago. The city is increasing fire staffing and pursuing a merger with Gold Ridge Fire Protection District. The fire department accounts for 10% of the city’s budget.

CITY INFRASTRUCTURE: City infrastructure includes streets, parks, Ives Pool, water and sewer, as well as city-owned buildings like the police and fire stations, the Senior Center and Community Center. Public Works, which maintains many of these, accounts for 12% of the budget.

Sebastopol has some serious infrastructure problems:

40% of the city’s streets and roads are in either “poor” or “very poor” condition. Current estimates suggest the city needs an additional $900K a year to maintain our assets such as parks, the Senior Center, and to protect city streets from further deterioration. Modest improvements to our local streets and roads will require an additional $1.4 million annually.

The municipal pool needs upgrades to an aged facility.

The Community Center has delayed flood damage and needed fire safety repairs.

The Fire department has a failed rain gutter system and dry rot repairs.

The city’s financial dilemma

Next, Korinke dove into a description of the city’s financial situation. The projected budget for 2024-25 calls for approximately $15 million in expenditures. Revenues are estimated at $14.3 million. This means that the city still faces a deficit of approximately $670K. While significant, this is less than half of the $1.7 million budget deficit for the prior year.

In terms of expenditures, there is a forecasted decrease of $190,487 from the adjusted 2023-24 budget. The city cut much more than this, but it also added other items, such as technology upgrades for city hall.

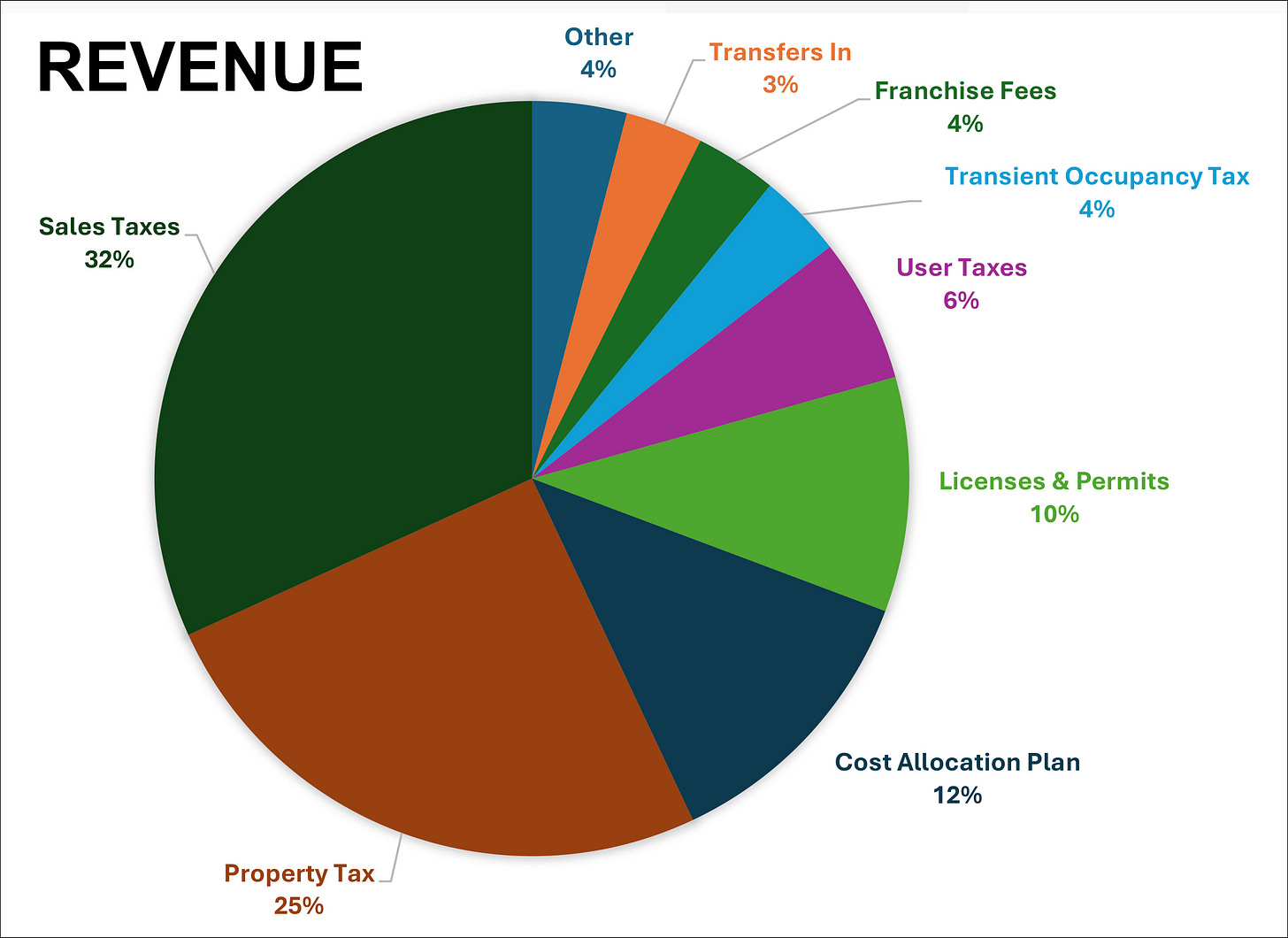

Where does the city get its money from and how does it spend it? These two charts tell the story:

What has been done to manage the budget?

The presentation described the city’s financial dilemma this way: The combination of rising costs and the city’s reliance on one-time revenues have contributed to a structural deficit for the city.

There isn’t a lot left to cut, as city staffing is near or below minimum levels. Unfortunately, if things go on as they have been, the city is at risk of depleting its reserves by 2027.

This year (2023-24) the city made the following changes to hold down expenditures:

There were reductions across departments, holding staff vacancies open, cutting contracts and reducing services.

Reduced support to local non-profits.

Reduced maintenance of aging infrastructure.

City working to consolidate fire services.

In the upcoming fiscal year (2024-25), which starts this month, the city is looking at further reductions, including…

Reduction in maintenance services and supplies for Public Works.

Reduction in funds for Police Department equipment.

Reduction (though not elimination) of support for the Community Cultural Center and Senior Center.

Reduction in city contracts.

Combining city Engineering and Public Works departments for efficiency.

Another solution to the city’s deficit is raising revenues. Korinke discussed the idea of an Enhanced Infrastructure Financing District, which would generate new revenue without raising taxes on residents. He introduced some of the city’s economic development strategies, including streamlining the application process for new businesses and supporting the development of new hotels, which could generate more than a million dollars in TOT tax revenue. Korinke also noted that the city had secured nearly $5 million in grants in recent years.

Potential Revenue Measure

The city is still considering putting a measure for either a 1/4 cent or 1/2 cent sales tax on the November ballot. A ¼ cent sales tax would provide approximately $760,000 per year, while a ½ cent sales tax would provide approximately $1.5 million annually.

Korinke then showed a graphic of where your sales tax goes. The city’s current sales tax rate is 9.25%; after Measure H (the fire protection tax passed this spring) is implemented, sales tax in Sebastopol will be 9.75%.

If voters passed either a 1/4 or 1/2 cent sales tax, the picture would look like this:

On the downside, that would give Sebastopol one of the highest sales tax rates in the county. On the upside, a half-cent tax in particular would go a long way to solving the city’s budget woes, though it wouldn’t raise enough money to fix the streets. Korinke noted that a sales tax allows Sebastopol to capture tax money from tourists and visitors. The following items are exempt from sales taxes, including most groceries, prescriptions and many medical supplies, rent, items bought with Calfresh assistance benefits, services and utilities.

Korinke also pointed out that this would be a locally-controlled general tax, with all funds deposited into the city’s General Fund for unrestricted general revenue purposes. All revenue would be kept local. By law it could not be taken by the State or transferred to another agency.

City voters would have to approve the proposal via a November ballot measure. At the July 16 city council meeting, the city council will once again consider putting a 1/4 or a 1/2 cent sales tax on the ballot. This will be their third or fourth attempt to do so since last year.

Questions and Answers

After Korinke’s presentation, the floor was thrown open to questions.

Is there an option to have the County Sheriff’s Office take care of our policing?

Police Chief Ron Nelson: During this year’s budget process, we took a look at any options that were possible to be as lean as we possibly could and as fiscally responsible as we possibly could. I had conversations with the Sheriff’s Office on what it would look like and what it would cost to contract all of our police services out. The figure that came back was approximately a million dollars more per year than what we’re currently paying. And that did not include the cost of any vehicles that might be needed or replacement vehicles.

Why hasn’t the hotel project across from the town square broken ground yet?

City Manager Don Schwartz: The Hotel Sebastopol is basically up against a financing challenge, with interest rates as high as they are now. A few months ago, they told us that lending in the hospitality market and for hotels has essentially been frozen, and it wasn’t available at all. About a week ago the city council approved an agreement with them that essentially extends an arrangement for them for three years to give them time to get their financing in place … So this is a way to entice them to build here. But it’s a $90 million project, so the costs to finance that are really substantial. And of course, it’s been in the planning process for quite a few years: COVID happened, interest rates are up—so that’s the story on that one.

They’ve indicated they do intend to build. They have invested $8 million in the project so far.

We also received an application from the owner of the Barlow to build a hotel on their property. We’re working our way through it, so we don’t have a definitive timeline for that either. But you know, hotels are great tax generators, and they’re also good for the local businesses because they provide a lot of people who will go to restaurants and events here, etc. So they’re very strong for the economy.

Where are all the people who move into the Woodmark apartments on Bodega going to park? I’m worried they’ll just spill over into the surrounding neighborhoods. I’m also worried about the traffic—and what would happen in an evacuation. Can you put in a traffic light?

Building Inspector Steve Brown: At this point there are 48 units that are being built there, not the full 84. So we will get a few years before the other portion of those are built to see how it works. The second phase is not going to start for three to five years at least. Don talked about interest rates—well, that also affects the amount of basically free money that’s available for affordable housing.

I believe there’s 203 parking spots planned on that site for the 84 units that eventually we will be built. So it’s basically 2.6 parking spots per unit. Although some of those units are three bedrooms, there is quite a bit of parking on that site.

At this point, we’ve done a traffic study, and a traffic light is not warranted. Although I do sympathize with you. I drive that traffic every day in the afternoon. It’s horrible. But at this point, the traffic light is not warranted. So we’ll see how it goes.

Police Chief Ron Nelson: Regarding evacuations, you’re absolutely right—we’ve seen some of these horrific clips of backups and what not. The problem is when people wait [to evacuate]. So what I urge everybody to do—which will assist in it not becoming a logjam with people getting trapped and having to run for their lives—is when those evacuation warnings are issued, that’s when it’s time to go. Do not wait until the evacuation order comes out. By then it’s too late. You’re in a whole world of hurt. I urge everybody to sign up for SOCO Alerts. It’s an online program. They will alert your phone directly and you will get both the warnings and the evacuation orders.

How much will it cost to put the sales tax measure on the ballot?

City Clerk Mary Gourley: The direct city cost paid to the county is about $14,000.

Given that policing takes up such a large part of the budget, have we looked at alternative service models that rely less on full time sworn police officers versus other kinds of service providers?

Police Chief Ron Nelson: As a matter of fact, we have. We currently have a recruitment out for what’s known as a per diem position for police officers. That's essentially a part-time position.

City Manager Don Schwartz: I’d like to elaborate on that, with a little bit different angle, if you will. One of the conversations we had with our budget committee—which is the Vice Mayor Steven Zollman and Councilmember Maurer—and it’s in the budget document as something to explore—is there’s a program called SAFE or Specialized Access for Everyone…And basically the idea of this model is to—for a considerable number of calls, I think it’s 5% of police calls or maybe a little more—are handled by people who are mental health professionals…It’s not an inexpensive program, but Measure O, the mental health tax, that we all voted for and that’s in place now, helps offset about half the costs…It’s good for the folks who are getting the help that they need, because they’re getting somebody better able to respond to their needs. It’s better for the police officers because it’s not really their area of expertise. So it’s really a terrific program if we can find a way to make it happen here. It’s kind of ambitious to think about expanding to new programs in the situation that we’re in financially but, you know, this is an ambitious community and an ambitious city council. We'll see if it’s something that they want to support as part of next week’s budget conversation.”

Does the city have someone working on grants?

City Manager Don Schwartz: In terms of grants, we have had a grant writer, but we have not had great success lately with that service. One of the criteria for many grants is relatively low-income communities, which we are not and so we don’t qualify for quite a few opportunities that other communities might qualify for. But where there are opportunities we do try and take advantage of them.

Assistant city manager Mary Gourley: We have found going through the grant process—this year the city did spend $60,000 for a grant writer. We applied for about 15 grants, and we received a couple but not of incredible value. And one of the reasons was because we don’t meet the criteria for underprivileged communities.

I'm thinking about vacation rentals. Do we feel like we're collecting all of the taxes possible on vacation rentals in Sebastopol.

City Manager Don Schwartz: We do collect transit occupancy tax or hotel tax from vacation rentals. We are pretty confident that we’re getting what’s owed to us and part of the reason is that there’s a couple of services out there that basically scan the Internet to see who’s offering VRBO or Airbnb or those sorts of things, and then tracking that against who’s paying the taxes for us. So there's a kind of an enforcement tool and I understand that we do use one of those tools to help ensure that we’re getting our fair share of that. Is that right, Mary?

Assistant city manager Mary Gourley: That is correct. We do have a service that is actually out there searching to see if they [vacation rentals] are registered. They notify us and then we go out there and make sure that they’re paying their taxes.

My question is about revenue generation and specifically if we’ve considered additional taxation on ultra-high net worth individuals—so not just general tax increases, but really targeting the ultra wealthy?

Consultant Robb Korinke: Cities can’t impose income taxes.

How much do roads cost and how is that part of the budget?

Public Works Director Dante del Prete: I can I can give you a rough estimate: about a million dollars a mile…Every time we have to reconstruct a roadway, there’s requirements to upgrade the current ADA standards of pedestrian walkways, pedestrian improvements, so not all street money goes to pavement. We’ve also fallen so far, far behind that we’re no longer in maintenance mode on many streets. They’re at a reconstruction rate. And as you know, construction and commodities are going through the roof.

See Part 2 of this article—questions from the Zoom town hall.