Sales tax measure and the fate of the bunya bunya tree

Part 2: Recap of the Sebastopol City Council meeting of May 21

This is Part 2 of a two-part recap of the May 21 city council meeting. Read Part 1.

The first three hours of the May 21 council meeting, devoted to water and sewer rates, were so bruising (see Part 1) that I wouldn’t have blamed the council if they’d simply gone home afterward—or chosen some lightweight agenda item to round out the evening. Instead, they slogged onward into an even more divisive issue: whether to put a sales tax measure on the November 2024 ballot.

They’d tackled this issue before in the summer of 2023, when Councilmembers Neysa Hinton, Diana Rich and Stephen Zollman attempted to get a quarter-cent sales tax measure onto the November 2023 ballot. This effort, which required a four-fifths vote of the council, was scuttled by Councilmembers Sandra Maurer and Jill McLewis, who said they felt it was rushing things.

City Manager Don Schwartz kicked off the presentation with some grim numbers. The city is looking at a $2 million deficit next year and a $2.9 million average deficit in coming years. And that’s not counting the roughly $1.4 million a year the city needs for road repair. Schwartz figured the city would need approximately $4.3 million to fill the gap.

Schwartz said “I don’t think there is any one fix to the fiscal emergency. I think we’re going to need a mix of strategies, including new revenues,” such as transient occupancy taxes from new hotels and the sales tax under discussion. Schwartz said that hotel taxes plus a quarter-cent sales tax would close 65% of the gap, while hotels plus a half-cent sales tax would close 80% of the gap. He thought the city could make up some of the difference through cost-cutting measures as well.

After this introduction, Alex Mog of Redwood Public Law, launched into an in-depth analysis of what it would take to get a sales tax on the ballot in November.

Sebastopol’s current tax rate is 9.25%, and it breaks down like so:

According to Mog, the city has the legal authority to ask for either a quarter- or half-cent sales tax.

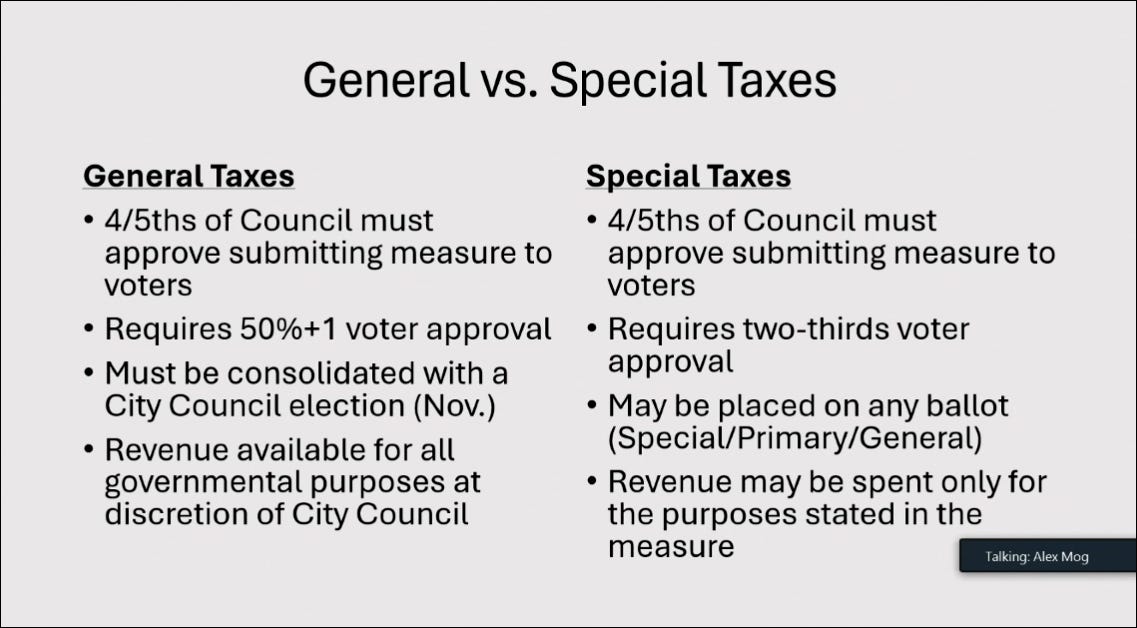

He then broke down the difference between a general tax and a special tax. A general tax, he said, can be used for any governmental purpose. A special tax is used for a specified purpose. Both must be approved by a four-fifths majority of the city council to put them on the ballot. In the election, a general tax must be approved by a simple majority (50% + 1), while a special tax requires a two-thirds majority (66.66%).

The council had several questions to answer regarding a sales tax: Does it want to put a sales tax on the ballot in November? If so, should it be a quarter-cent or a half-cent sales tax? Should the city hire a pollster to suss out the public’s opinion on the sales tax increase and perhaps an election consultant to run an outreach campaign? And how much would all that cost?

These are the questions the council batted around for the next two hours.

According to City Clerk Mary Gourley, the cost might be as high as $55,000. $15,000 to $18,000 in election costs; $25,000 to $30,000 for a consultant to do polling and educational outreach; plus $10,000 in legal fees.

Vice Mayor Zollman asked if there was a danger in coming back to the voters so many times for different issues: fire, water and sewer, and now a sales tax hike.

“Your city’s not unique in facing these layered, competing needs,” Mog said. “A lot of cities are facing the same kind of fiscal pressures and are looking at multiple different revenue streams. In a vacuum, it would be wonderful to have only one proposal before voters—only one revenue enhancement taking place in a municipality at a time—but unfortunately that is not the world we live in at this time.”

Zollman also asked why the city couldn’t just use the polling data they’d paid for last summer when this issue first came before the council. Mog responded that voters opinions can change a lot over the course of one year.

Councilmember Sandra Maurer asked if the city had regularly hired an election consultant in the past. Gourley said they’d hired a consultant for the most recent election but not before that.

Jill McLewis said she’d been at a Cal Cities meeting where the consensus was that this November was going to be a very tough ballot, what with all the competing measures. Election consultant Robb Korinke responded that, while competing measures were a problem, “voters are typically more supportive of money that stays local.”

There was some movement in the councilmembers’ positions. Whereas Councilmembers Maurer and McLewis had, for different reasons, opposed even a quarter-cent sales tax measure last year, this year both seemed at least open to the idea of a quarter-cent measure. Both remained firmly against the idea of hiring another election consultant, however.

Mayor Rich supported the concept of polling because, as she said, “I really want to know what our public feels about this.”

In the end, it was clear that the council was going to split along the same lines that it did last summer. Once again a bare majority of three members—Mayor Rich and Councilmembers Stephen Zollman and Neysa Hinton—voted “to move forward with the staff direction to test the percentages for a potential sales tax measure, to conduct the outreach education and polling, and to authorize staff to use up to $30,000 for such polling and education outreach.” Councilmembers McLewis and Maurer dissented.

The triumph of the bunya bunya tree

Six months ago, the Barlow requested permission to remove a 100-year-old bunya bunya tree. The Design Review Board denied this request, so the Barlow appealed this decision to the city council. Strangely, by the end of the evening (it was late—almost 11 pm), the Barlow representative had disappeared and only a few tree defenders remained in the council chamber. The tree’s defenders spoke up during public comment, then the mayor read an email she’d received earlier from Barlow owner Barney Aldridge:

“I hope you guys will vote to save the tree. The Barlow is hyper-focused on public safety. It's difficult to know when to intervene. Sometimes you have to let nature do her thing, and we people have to manage around her the best we can. The tree is magnificent and never did a thing to anyone that I know of. It's not my decision. I trust the experts and our city council will make the right decision whatever that is. For me personally. I hope she can stay standing tall.”

And with that, the council denied the Barlow’s appeal to cut down the tree.

“I’m so grateful that I live in town where people love their trees,” Councilmember Maurer said.

“I think it’s a lovely way to end this meeting,” said Mayor Rich.

And that was that.

Laura, et al

Thank you for your endeavors and accomplishments to inform we citizens.

Yea! The tree is saved! I hope that Luther Burbank did plant it and he is up in heaven clapping! 👏